Understanding Market Trading: Option Pain

What if some market paranoiacs are right? What if influential individuals manipulate price movements in the market to provide the best revenue for himself? How should one act to guarantee the maximum profit?

If we take a look at the stock market, maybe it’s a good idea to buy large quantities of stocks and increase their prices, then sell and get a profit? But in this case, ROI (return on investment) would be measured in tens of percents. It’s not a huge value for such a powerful broker, you know.

If we take a look at the stock market, maybe it’s a good idea to buy large quantities of stocks and increase their prices, then sell and get a profit? But in this case, ROI (return on investment) would be measured in tens of percents. It’s not a huge value for such a powerful broker, you know.

Let’s imagine that influential individuals can set any price they wants. Then, in that case, it’s better to go with options. In a short period of time, a person can sell a lot of option contracts and win their value on the expiration date. These options will cost nothing on the 3rd Friday – the trader will adjust the underlying price.

But he can’t sell a lot of contracts based just on a strike price. There aren’t so many “stupid” investors who will buy these options. The trader needs to spread strike prices within almost an entire range for put and call options.

It has been observed over and over again that, near option expiration, option buyers suffer significant losses. According to a NY Times quote, it is likely that option sellers, including proprietary traders, “manipulate stock prices by selling large numbers of shares whose prices they wanted to keep from rising and by buying other shares whose prices they wanted to support.”So, here is the question: Where should he set the underlying price to get the maximum profit? The obvious answer is that it’s the price where most of the other traders will lose the money. In other words, it’s the price where the most option contracts will be out-of-the-money.

Such a theory is called the “Option Pain Theory,” and can be used to determine the price where stock will be moved by someone to get the best profit. This price is called “Option Pain” or “Max Pain.” Different calculators can be found on the web, which are intended to detect the Option Pain price. One of the latest and most accurate methods to calculate the Max Pain was proposed by optionpain.com in 2008.

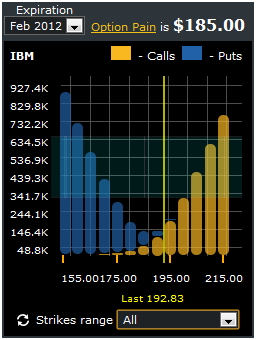

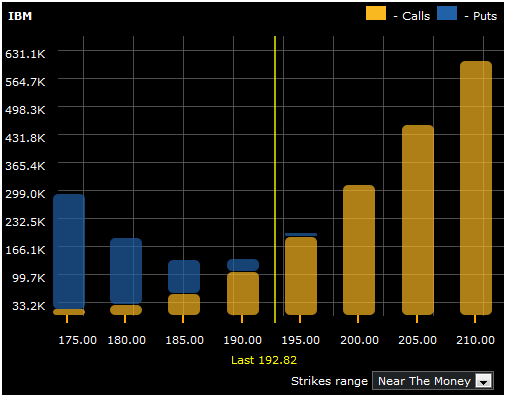

Take a look at the image – it’s currently equal to $185 for IBM stock. As the set of strikes is finite, Option Pain is always equal to some of the available strike prices. But exact underlying price on the expiration day can vary between the two nearest strikes. Profit will be the same for the trader (also he can be called an “Options Selling Group”) for all prices between $185 and $190 in the example.

Option Pain is just a theory, a very interesting theory. But it can’t be used as a strong recommendation for options or stocks trading.