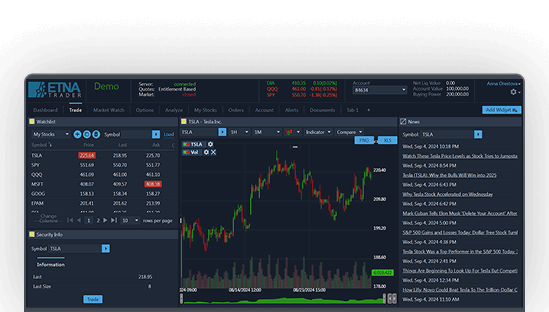

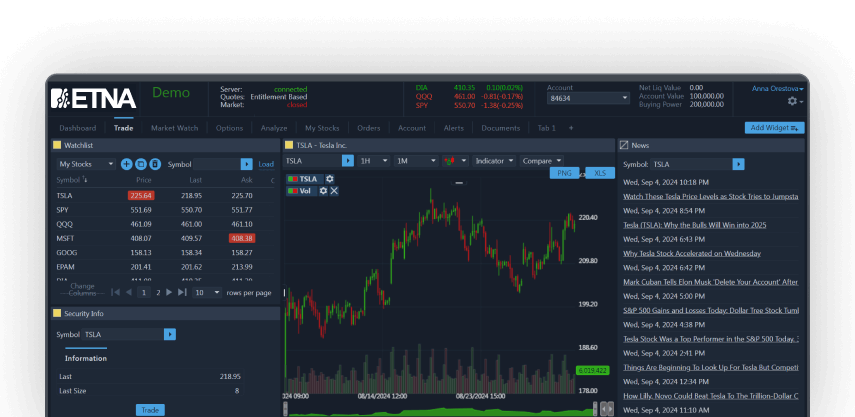

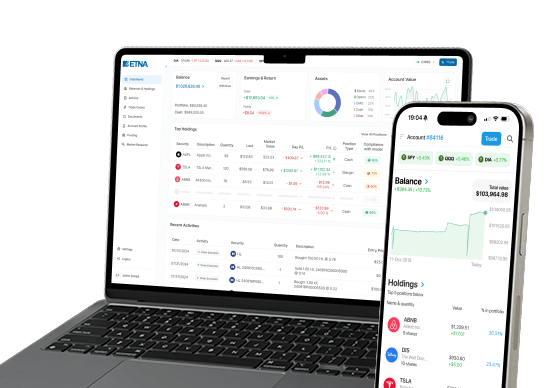

Software

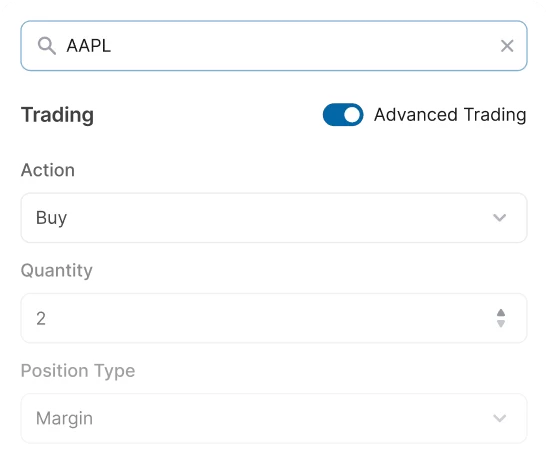

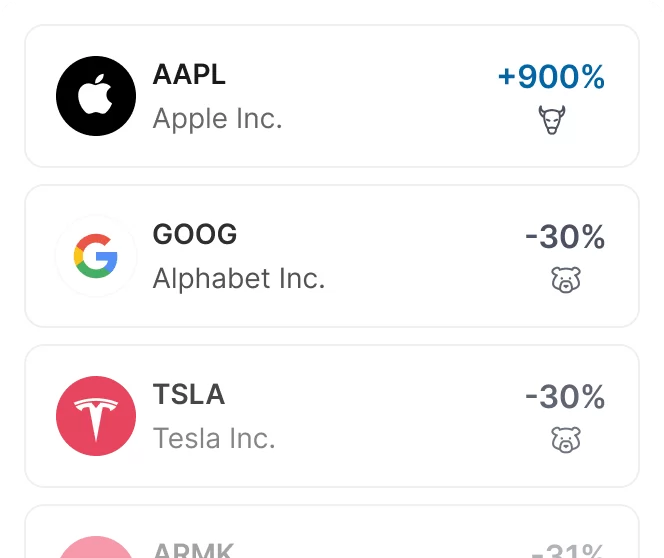

for trading

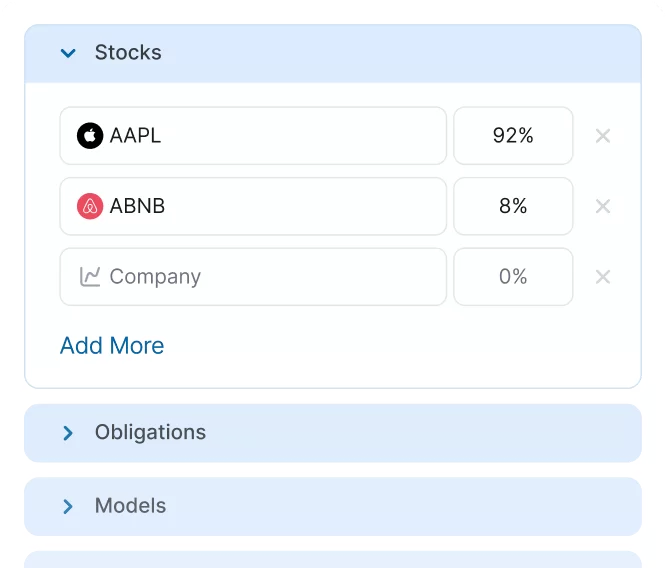

and wealth

management

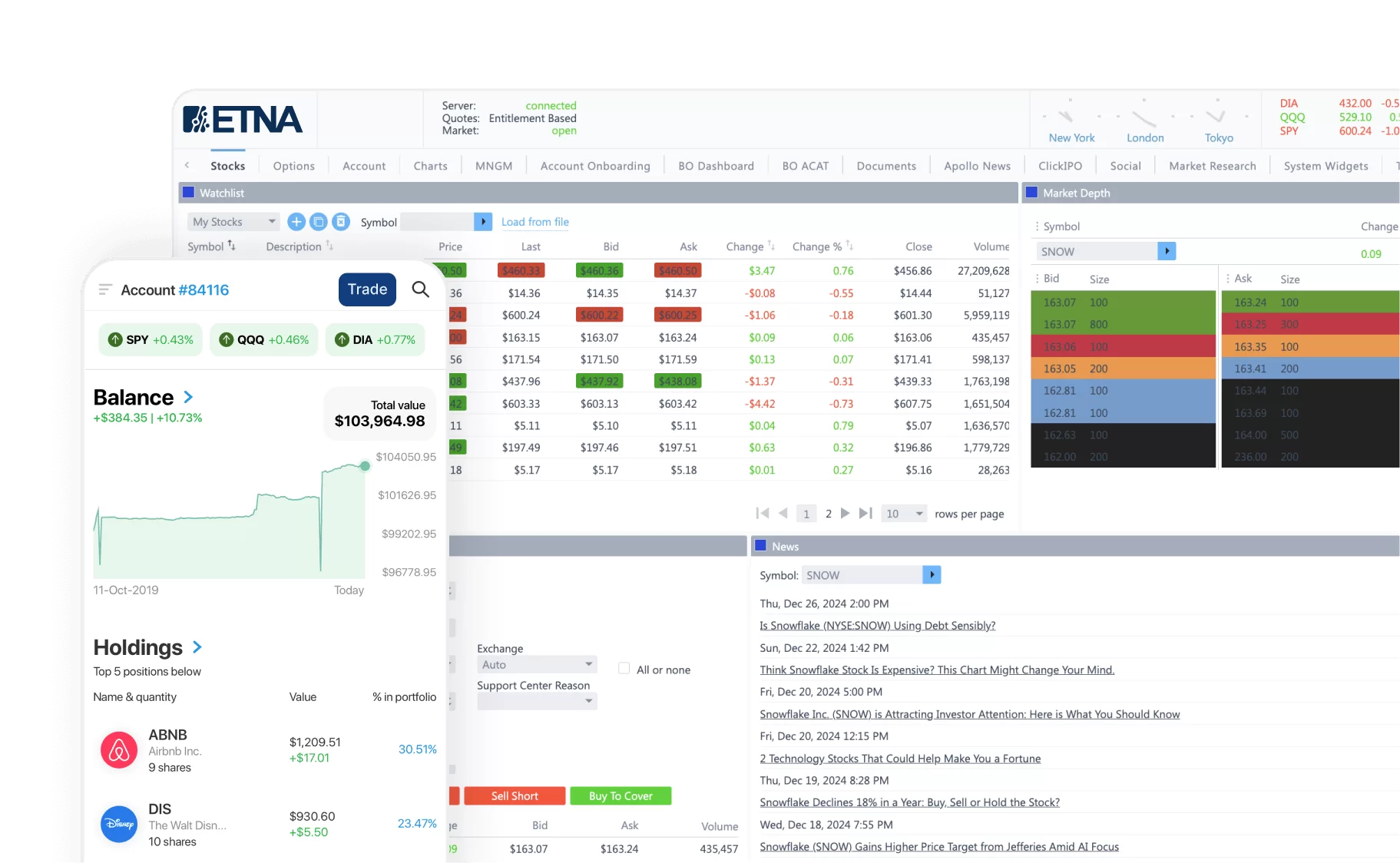

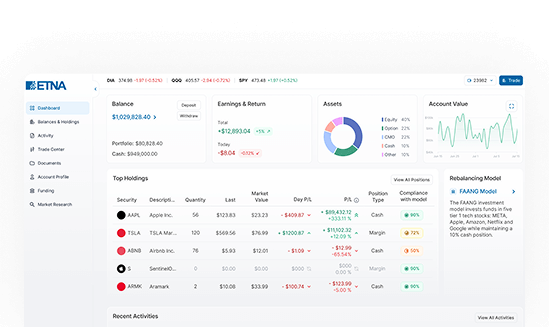

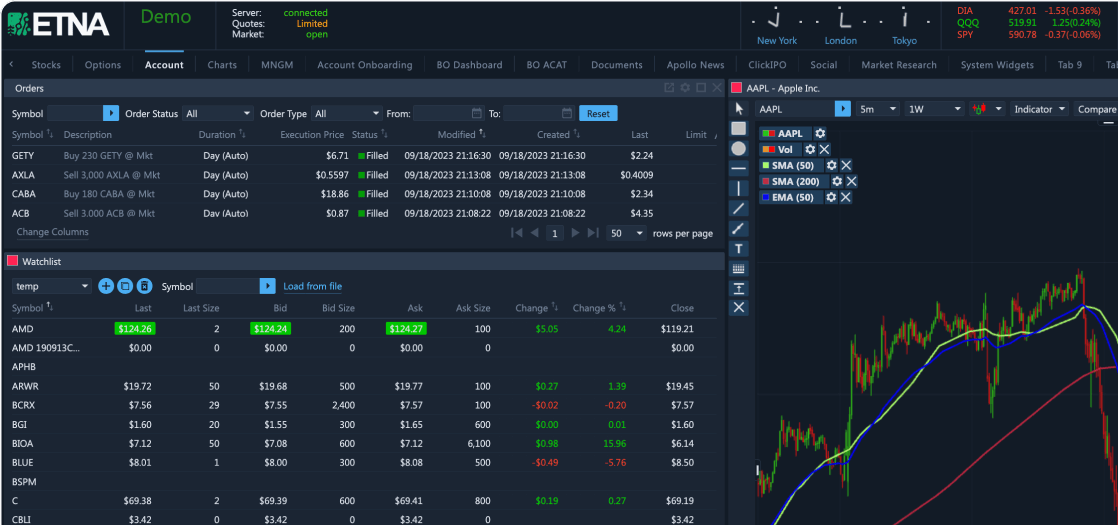

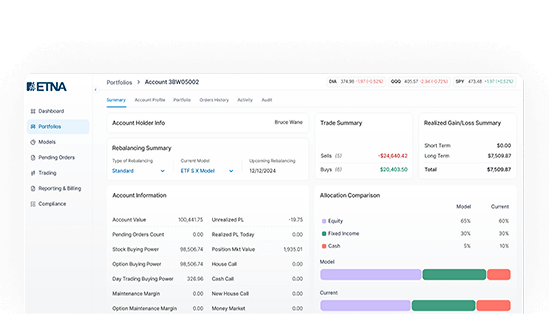

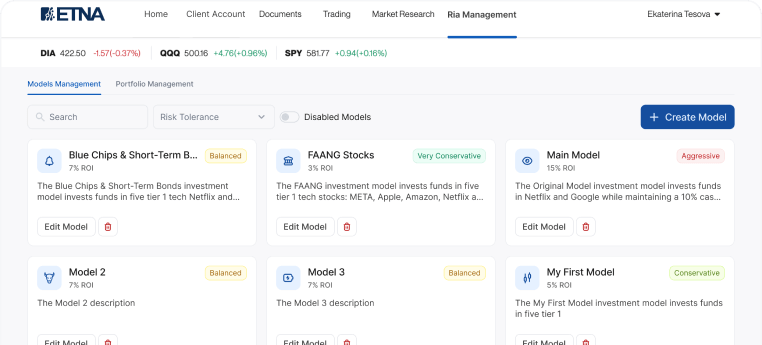

Discover ETNA – a family of fintech products for broker-dealers and RIAs. Combine platforms with apps, APIs, and tools for trading, client management, and portfolio growth.

White-label solution for: