Binary options (also called “Fixed Return Options”, “FRO”, or digital) are popular in the OTC market for hedging. They are also useful for speculators and for other traders to construct complex derivatives portfolios.

The payoff for these kinds of options is fixed. Buyers can get a fixed amount of cash or assets in case the option will be in-the-money or get nothing if options will be out-of-money on expiration date. That is the reason why these options are called “binary” – because only two outcomes exist for the buyer:

In addition to the OTC market, binary options are traded at AMEX and CBOE.

The payout amount for CBOE binary options is $100. CBOE lists both put and call binary options. If (at expiration date) the underlying price will be above the strike price, the buyer of call will receive $100 per contract; but if the price will be below the strike price, he will receive nothing.

Interesting point – the price of binary options with a $100 payout will reflect the probability that the underlying security price will reach the selected price at expiration. Example: price $0.25 means 25% probability.

Let’s take a look at the example – in Aug 2012, a trader bought a “cash-or-nothing” binary option contract with following terms:

Market conditions are as follows:

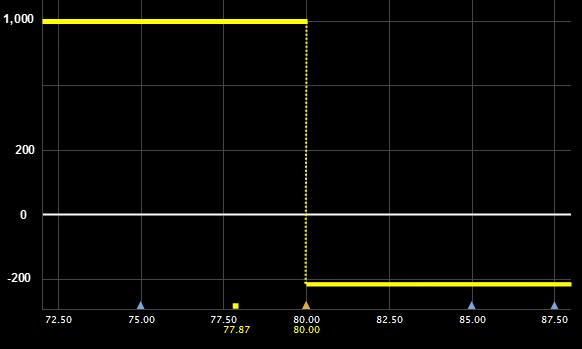

In this case, option will be quoted approximately $2.13 and P/L chart at expiration date will look like:

How do you calculate fair value and Greeks for binary option? According to the Black-Scholes model, a binary option is derivative of an European option (for example, the June 15th-strike call binary will be the mathematical derivative from the June 15th-strike vanilla option).

So, binary’s fair value has the same curve as vanilla’s Delta; and binary’s Delta has the same curve as vanilla’s Gamma.

Let’s take a look at the portfolio of binary and vanilla options with the following parameters:

![]()

Suppose volatility is 125% and interest rate is 1.5%. In regards to the Black-Scholes model, P/L and Delta charts will be the following:

|

Vanilla’s P/L |

Binary’s P/L |

|

Vanilla’s Delta |

Binary’s Delta |

Binary options have been introduced in two of ETNA’s solutions for option trading:

For more details or a demo presentation please contact us or call +1-855-779-7171

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.