Why FinTech startups shall think of going mobile first and how companies reimagine financial inclusion via mobile devices?

When people think about the FinTech revolution, it’s natural to imagine a western or eastern country filled with innovation. The United States and China, for example, are top of mind whenever people speak on the evolvingFinTech environment.

It’s hard to imagine that almost 2 billion people, almost 40% of the world’s population, don’t even have a bank account. Many of these people live in a developing country with a volatile economy.

Further on, roughly 10% of the world lives in poverty. This is why most people don’t think of countries in Africa or Asia when discussingFinTech opportunities.

Developing countries provide the greatest number of opportunities for FinTech firms. Mobile platforms, including mobile trading apps, and the increasing ability to connect online have flattened the world even further and allowed emerging economies to adapt the FinTech innovations faster.

More and more people now have smartphones and other mobile devices. While Internet connectivity might still be lacking in some developing countries, almost everyone can connect online via 3G- or 4G-enabled devices. Emerging economies are made up of people who can interact online.

For example, the total number of mobile subscriptions increased by 300 million worldwide between the period of 2010 to 2015. Mobile operator Ericsson expects there to be an additional 1.6 billion worldwide mobile subscriptions by 2020, representing a 3-billion-person increase in mobile connectivity.

The number of worldwide bank accounts among developing economies is also rapidly increasing. While 2 billion people still live without a traditional bank account, that number was 2.5 billion in 2013. And from 2011 to 2014, 700 million bank accounts were added throughout the world. This represents a 10% increase in adult bank accounts when compared to 2011.

As one can see, this provides an exciting opportunity to market FinTech products to emerging markets and economies. It’s a case of inclusion. In fact, most of the current innovation is happening in these emerging economies. Since traditional banking never got a foothold in these societies, it leaves room for FinTech companies to come in and offer unique services such as crowdfunding, digital investing and microfinancing.

With the current trends, it’s now an absolute must for any retail broker-dealer to offer mobile trading apps to their clients. This widens the world market to include these emerging economies. If a few years ago offering mobile trading apps was considered as something unique and luxury extra, available only for elite traders, now it is a necessity.

In Kenya, only a few people have traditional bank accounts. But almost every person in Kenya has a smartphone and is conditioned to use mobile apps, including mobile trading apps and banking . While Kenyan citizens might not be comfortable with a traditional banking branch, they are comfortable making mobile payments and online investments straight from their phone. They leapfrogged into a new world where financial services are mobile first. Recent experiments with basic income in Kenya may open even wider opportunities for FinTech startups there.

From 2010 to 2016, for example, mobile payments in Africa grew by over USD $40 million per year. And, this is happening all over the world.

FinTech trends like mobile payments and trading are expected to grow two to three times faster in emerging economies than in matured and developed economies.

It creates enormous opportunities for FinTech startups offering the much needed services to people like mobile banking and investing. Moreover, emerging economies have much less barriers for businesses, e.g. regulations than in mature economies of Europe and the US.

Have a great idea of FinTech startups? Or, looking to expand to foreign markets? First, start with mobile experience. It may be done even with a limited budget nowadays, when firms like ETNA provide APIs and white label mobile platforms. Secondly, consider launching in EMEA countries. It allows companies tap into the incredible growth of emerging markets and help innovate these economies.

Bonus video: Reimagining Financial Inclusion through Mobile

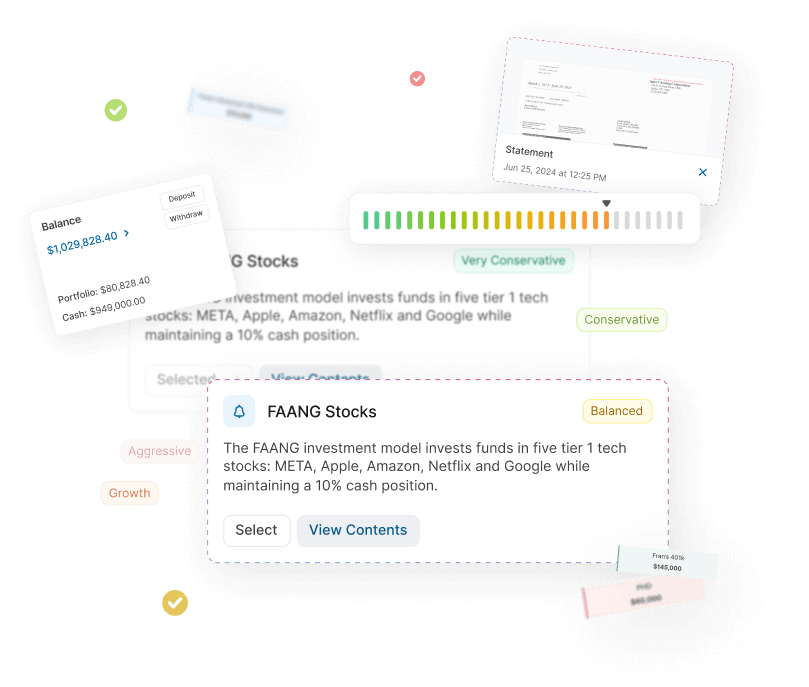

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

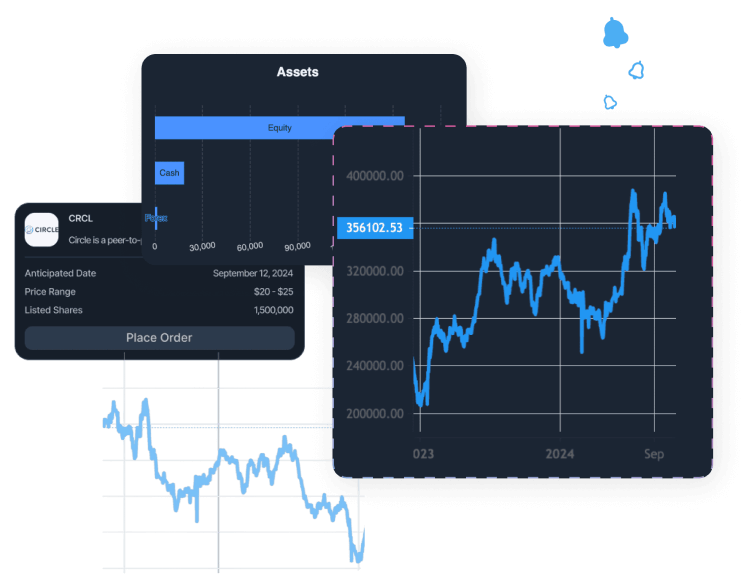

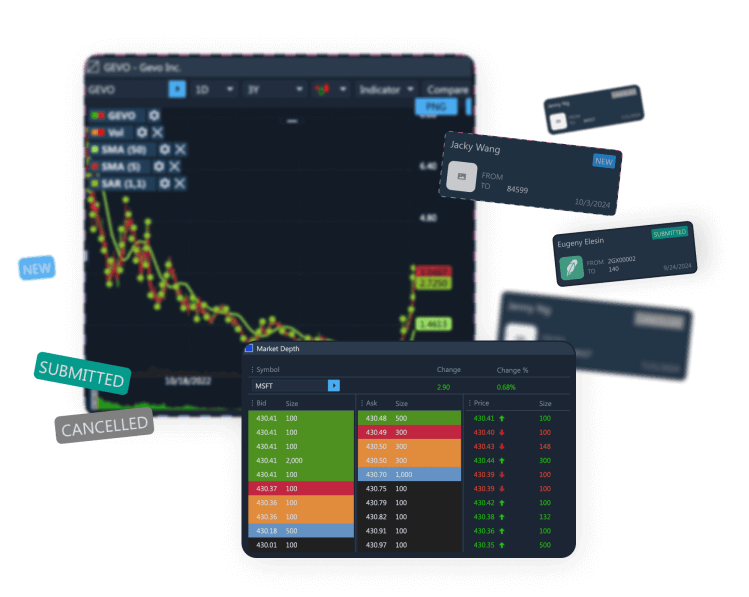

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.