The majority of contemporary theories claim that it is possible to predict the price of an asset by analyzing its historical performance. Contrary to this belief, there is also a theory that all prices change randomly and it is absolutely impossible to forecast the outcome. Provided that you have no intention to use historical data for analysis, the only strategy which seems to be possible is to sell short and hold. However, a large amount of research shows us that it is possible to make more money if you use different analysis tools. That is what I would like to investigate in this article.

Now we have a great opportunity to use neural networks in trading as well. The Nneural network receives the data provided by you or some market data feed and analyzes it. After the analysis is over, you receive the output data with a forecast of the possible performance of the asset in the future. The greatest advantage of neural networks is that you can perform analysis of the forecast after some time passes and you receive historical data of its performance as well. Then you can start all over again.

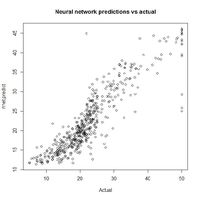

If we take some historical data into consideration and analyze it, we will receive output data. After that, we will be able to perform analysis of the data and check if the forecast of the neural network was successful. That is how we can valuate the performance of a neural network and decide if we want to proceed with this net or choose another one.

Artificial neural networks are widely used to analyze traditional classification and prediction problems in accounting and finance.

A bankruptcy forecast performance analysis showed that the accuracy of 5 different neural networks differed from 36% to 74%, while accuracy of fraud detection forecast varied from 75% to 93.2%.

Nevertheless, it is obvious from this analysis that the predictions of neural networks are more often correct than incorrect.

That is the reason why the application of neural networks to financial markets is becoming more widely used in different areas.

This solution seems to be perfect; however, it is not. There are some disadvantages which are the reason why neural networks are not used by every single trader in the world.

The application of neural networks to trading is relatively new. Because of that, it is still not proven that neural networks can analyze historical data perfectly with the expected outcome. The main disadvantage of neural nets is that they rely solely on the historical performance of the asset, and it is entirely impossible to foresee some events which can greatly affect the market. Also, regardless of graphical user interfaces, some neural networks use complex mathematical formulas and this can reduce the functionality of NN.

According to the opinion of some financial professionals, the market is a complex structure and it is impossible to learn all its trends. Provided that it is impossible for a human being to make accurate predictions, artificial intelligence which imitates a human brain cannot do it, either.

Neural networks can be modified to work with a significant number of software solutions. These systems have their own features and everyone can definitely choose something according to their preferences. However, it is impossible to ensure that neural networks will perform analysis and make forecasts exactly as one would want. That is the reason why I think that the best solution is to create your own neural network the same way as you would create any other algorithm. Creating the custom software solution with the use of neural networks could possibly be the best choice.

Currently, neural networks are not as popular with traders as other types of algorithms. It is obvious that they are getting more acknowledged by traders across the world. In my opinion, neural networks will develop even more.

You will be successful in trading with neural network algorithms only when you stop searching for the best one. You should never forget that this is a trading strategy which makes you successful, not a neural net.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.