Automated and AI-powered trading platforms are transforming broker-dealer operations, driving efficiency, compliance, and competitive advantage in financial markets. This multi-page guide provides a comprehensive 2025 comparison of top platforms, features, cost advantages, and actionable insights for B2B buyers, analysts, and new broker-dealers. Structured per top industry content standards and incorporating recent FINRA/SEC and market trend data, this blog is designed to support platform selection and strategic investment in automated trading technology.

Automated trading platforms now represent the backbone of institutional and retail finance. In 2025, over 70% of U.S. equity trades are algorithmically driven, with AI and machine learning solutions taking a multilayered approach to real-time data and risk management. The sector’s projected CAGR of 20% for AI platforms demonstrates rapid adoption enabled by cost-cutting, regulatory demands, and client expectations for best execution and transparency.

Automated trading systems (ATS) are technology frameworks that execute trades based on predefined rules, algorithms, or real-time analysis often powered by AI. They support multi-asset strategies, integrate risk controls, and automate reporting for compliance and operational efficiency.

| Segment | 2024 ($B) | 2025 ($B) | 2030-32 ($B) | CAGR (%) |

| AI Trading Platforms | 11.23 | 13.45 | 33.45 | 20 |

| Algorithmic Trading | 21.06 | 23.48 | 42.99 | 12.9 |

| Automated Algo Trading | 17.6 | n/a | 49.53 | 10.9 |

| Online Trading | 10.15 | 10.82 | 16.71 | 6.4 |

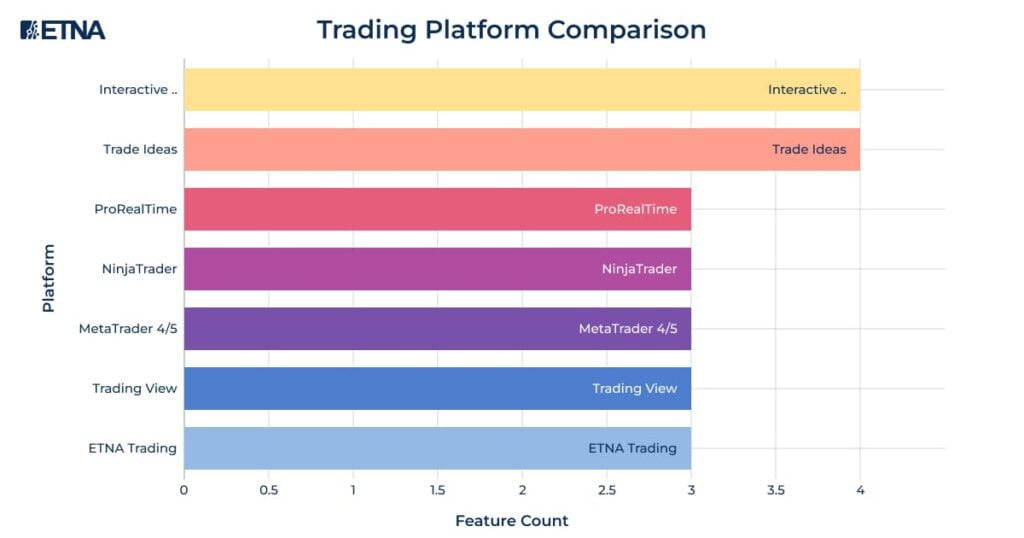

| Platform | Target Audience | Key Offers / Strengths | Automation Type | Compliance Controls | Broker Integration | Typical Cost Model |

| ETNA Trading | Broker-Dealers, RIAs | Multi-custodian, VWAP/TWAP, white-label | Advanced algos, risk mgmt | FINRA/SEC, full suite | Open API, full stack | Enterprise license |

| Trade Ideas | Active Day Traders | AI Holly Engine, real-time signals | AI automation, backtest | Risk controls, alerts | Broker Plus integration | $127-254/mo |

| TradingView | Retail/community | Charting, scripting, social features | Limited (alerts/scripts) | Moderate, some brokers | Multi-broker support | Free, paid premium |

| MetaTrader | Forex & derivatives | Expert Advisors, deep community | Script automation | EA controls, limited B/D | Wide, focused on forex | Bundled, spread commissions |

| NinjaTrader | Futures traders | NinjaScript, advanced strategies | Script automation | Futures compliance | Direct/dedicated brokers | License + commission |

| Interactive Brokers | Institutions | API, global reach, full asset support | API automation, portfolio | Extensive, multi-market | 150+ markets, APIs | Commission-based |

| ProRealTime | Advanced/technical | Professional charts, backtesting | Full strategy automation | Accurate backtesting | API, various integrations | Premium license |

Consider licensing, integration, cloud hosting, and support vs. savings from automation all while accounting for compliance risk mitigation (fines, regulatory actions) and improved client retention.

The future of broker-dealer operations will be defined by institutional-grade automated trading platforms that combine advanced AI, regulatory intelligence, and operational efficiency. The 2025 market rewards decision-makers who invest in platforms such as ETNA Trading where multi-custodian support, modular algorithms, and compliance automation deliver sustainable growth.

Explore how ETNA Trading’s automated, white-label platform can transform your broker-dealer operations. Schedule a personalized tour and see scalable, compliant automation in action.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.