What sets leading broker-dealers apart in 2025? It’s not just client volume or product variety – it’s the infrastructure beneath it all. Broker tools have become the strategic lever for firms looking to scale, stay compliant, and differentiate in a crowded market. No longer just support systems, these tools now shape the client experience, power real-time decisions, and define operational agility.

This article explores how U.S. broker-dealers can build a flexible, future-ready ecosystem by combining advanced tools for brokers, robust trading infrastructure, fintech innovation, and platform evolution, with ETNA’s architecture as a real-world example.

Broker tools have evolved from simple trading terminals into integrated ecosystems encompassing:

Choosing and integrating the right set of tools for brokers is now a strategic decision, directly impacting client retention, operational efficiency, and regulatory alignment.

Modern trading infrastructure is about more than speed – it’s about reliability, scalability, and adaptability. Key elements include:

A robust infrastructure empowers brokers to launch new products, serve global clients, and operate securely – even in volatile markets.

Fintech is reshaping every layer of the brokerage experience. Today’s broker tools embrace:

Use Case Example: Imagine a broker managing a group of retail investors interested in tech stocks. The sentiment module identifies a surge in positive sentiment around a particular semiconductor company based on trending discussions across Reddit and X. The broker receives this alert and uses it to inform clients via the platform’s notification system, suggesting potential review or action. Some clients opt to add the stock to their watchlist, while others request further analysis – enhancing both engagement and perceived value.

These innovations allow brokers to operate smarter, reduce cost-to-serve, and offer personalized digital experiences.

Broker platforms are transitioning from rigid systems to agile, API-first ecosystems. The most successful firms:

This approach ensures flexibility and long-term adaptability in a dynamic market.

ETNA’s broker tools are built on a modern, modular architecture designed for scalability, compliance, and speed. Core layers include:

Together, these layers create a turnkey ecosystem ready for brokers, advisors, and hybrid firms.

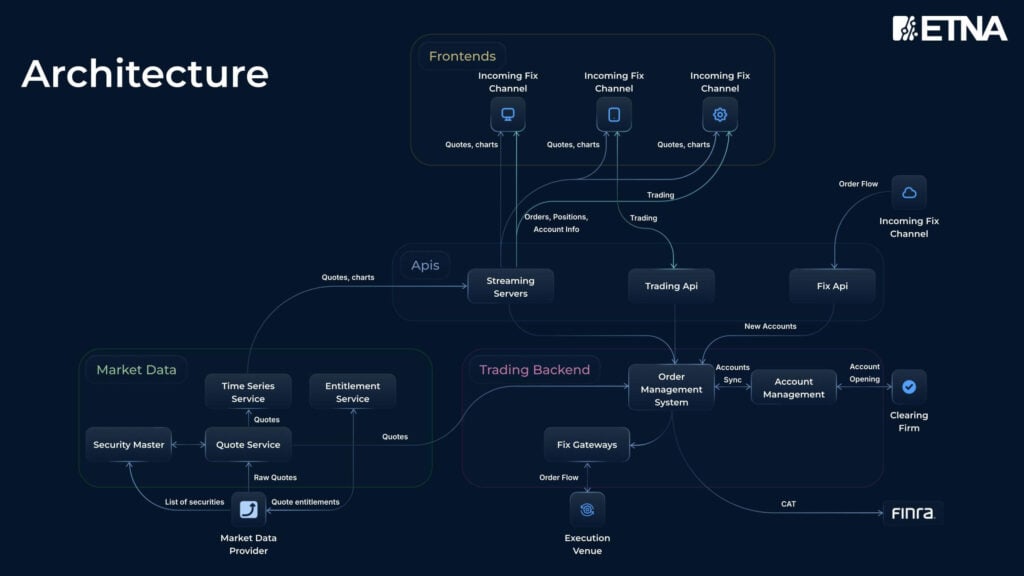

The following architecture diagram illustrates how ETNA’s modular system connects frontends, APIs, trading backends, and market data layers into a unified infrastructure:

To visualize platform evolution, here’s a staged progression chart that reflects how broker-dealers mature their infrastructure and capabilities over time:

| Stage | Description |

| 1. Terminal Access | Execution-only setup with basic trading functionality |

| 2. Core Infrastructure | Includes OMS, back-office modules, and compliance automation tools |

| 3. API Ecosystem | Integration with custom UIs, external services, and white-label components |

| 4. Performance Dashboards | Real-time metrics and operational monitoring |

| 5. Sentiment Engagement | AI-powered social sentiment insights and watchlist tools |

This evolution path allows broker-dealers to scale at their own pace – starting with foundational systems and expanding into intelligent engagement. ETNA’s modular platform supports each phase, enabling rapid progression without disrupting existing operations.

To make this more actionable and visual, here’s a diagram-friendly checklist showing the core steps in developing a flexible broker platform ecosystem:

The global e-brokerage market is on track to grow from $13.5B in 2024 to $22.5B by 2030, driven by increasing investor activity, embedded finance, and AI-powered tools. According to Research and Markets, innovations like risk profiling and automated portfolio rebalancing are becoming critical for client satisfaction and retention.

Other drivers include:

Firms that invest in adaptable infrastructure and modular innovation will be best positioned to capture this growth.

As the brokerage industry enters a new era, broker-dealers need more than just tools – they need a partner that understands trading infrastructure, fintech innovation, and scalable platform design.

ETNA empowers firms with a unified ecosystem that combines execution, compliance, and analytics – plus the flexibility to evolve with client needs and market conditions.

Ready to future-proof your brokerage? Discover how ETNA’s broker tools can transform your business and drive long-term success. Schedule a demo or contact our team today.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.