Whats is an API? What is a stock trading API and why it matters? Let’s start with history and stories.

Prior to 1996, when Microsoft launched the product that would become Outlook, email as a business communication tool didn’t really exist. In the pre-email days, the fastest way to share a piece of information was to trust in the US Postal Service or to hire a courier. In either case, businesses would have little choice but to seal up their message, hand it over, and wait.

Nowadays, Application Programming Interfaces (or APIs) are the couriers of the internet age. Emails may handle the day-to-day letters, but APIs get more complex information and data from point A to point B.

So, what is an API and how have they become integral to businesses?

Returning to the pre-email days, just think of all of the problems that could beset a simple posted note. Maybe the courier couldn’t find the address. A parcel full of valuable market data could be damaged in transit. Think of the complexities of sending something to a different country.

An API essentially allows two computer programs to “talk” to one another. They handle the exchange of data between the two programs and ensure that each program can interpret the data being sent. They ensure there’s no ‘damage in transit’, eliminating risks and allowing each program to do what it needs to do with the data, before potentially sending something else back the other way.

Although they are rarely seen or talked about, APIs are everywhere nowadays. Any time data from one program, database or piece of software needs to be used by a different piece of software, an API is usually involved.

Imagine an online travel business handling airline and hotel bookings. The data the business needs to be effective in its customers’ eyes is vast. They need up to date prices and dates from the airlines, along with schedules and seating charts. They need reservation information from the hotels along with room availability and rates. Every time a customer makes a booking, whether through this online travel business or another, all of the data points change. Rates, availability and review rankings could all shift on a minute-by-minute basis and the business must be on top of them all to offer the very best level of service.

If this business had to handle that data through the mail, or even over email. It would require man hours of labour and a huge lag in the time between data reception and data usage by the business’ customers. By the time all of the data was in place it would all be out of date again.

An online travel business such as this will use data provided by the airlines and hotels, sorting and displaying it in their own way. The data originally sits in a database the airline or hotel manages, is then handled by an API and ends up on the website of the online travel business, whose clients get the up-to-the-minute information they need. When a purchase is made, the booking goes back through the API to the airline or hotel. The end user gets a completely seamless experience, and the business gets a new customer, thanks to an API.

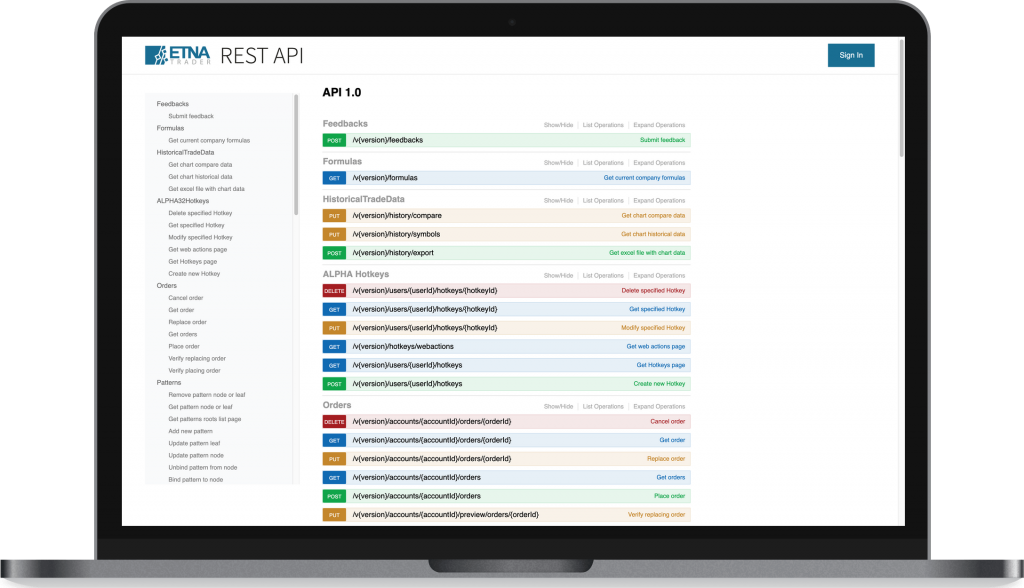

A stock trading API for brokers works in exactly the same way as the airline and hotel examples; just substitute flights with things like market prices, stocks information and fractional shares.

Using a stock trading API, businesses can take all of the data held by the capital markets, put it into an interface that makes sense for them and then send further data back to the markets. This data, at the simplest level, could be the instruction to place a trade, close or modify a position. An effective stock trading API is the ultimate ‘courier that cares’. It takes useful data, gives it to businesses to use in their own way and then carefully carries back what the business wants to do with that data to the original sender.

The data that stock trading APIs provide make them a natural fit for the needs of brokerage businesses. More than just using the data to service existing clients, brokers can put stock trading APIs to work to grow their client base further.

Linking an advisor’s portfolio management system to a broker’s online functionality through a stock trading API enables advisers to save on the execution, increase the level of automation in their service and to even earn money on rebates. Brokers add to existing trading volume easily connecting new advisors through API.

Using a stock trading API brokers can offer start-up businesses a much easier route to market. Rather than having to develop all the trading infrastructure themselves, FinTech startups can get access the existing technology that has already been developed by the broker within their offering, through APIs. It’s a win-win situation where startups get access to market and save resources on development and brokers improve product offering by offering new features to their clientele at a fraction of a cost and grow trading volume at the same time.

Over 10 years the FinTech ecosystem has grown significantly and so have the opportunities for online broker-dealers. Research and analysis communities built around certain brokerage APIs could be a great opportunity to create a strong community of people who share views and opinions about capital markets or background. It doesn’t take a huge leap to see this as a potential whole ecosystem that could grow organically to something big and become a network for a personal finance management portal or “self-driving wallet”. Here’s to the next “Stockbook”.

Schedule a call with ETNA Sales Team to learn how we can help your brokerage business grow today.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.