Clearing Software

for Brokers and Wealth Firms

Automate post-trade operations with a fully branded, multi-asset clearing solution, ready in just 2 weeks.

ETNA Clearing is a robust, white-label post-trade solution tailored for US broker-dealers and wealth management firms. Designed to simplify clearing processes, ETNA integrates seamlessly with trading platforms, back-office systems, and investor advisor tools, delivering unmatched efficiency and accuracy.

Whether handling equities, options, ETFs, mutual funds, IPOs, UITs, fractional shares, or cryptocurrencies, ETNA Clearing ensures real-time workflows that scale with your business needs. Our solution empowers firms to reduce operational overhead, enhance risk management, and improve client satisfaction — all while maintaining compliance with regulatory requirements.

Key Benefits:

Launch a fully branded clearing

solution in about two weeks

Automate trade validation,

settlement, and reporting processes

Built-in tools ensure adherence

to SEC and FINRA regulations

Manage trades across stocks, options, ETFs, mutual funds, IPOs, UITs, fractional shares, and cryptocurrencies

Connect to over 20 execution venues

and clearing firms for unified operations

ETNA Clearing Features Grouped by Functionality

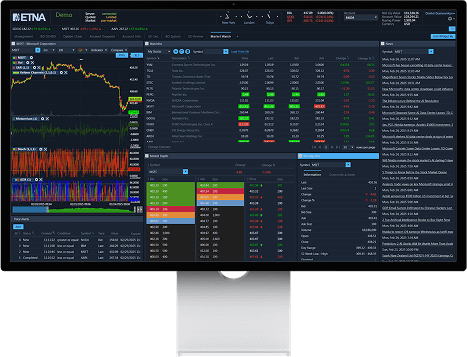

Trade Execution & Validation

24x7 Real-Time Trade Validation:

Validate trades instantly for accuracy and compliance at any time of day or night. This ensures uninterrupted operations and reduces discrepancies across global markets.

Real-Time Clearing:

Process trades in real-time to accelerate settlement cycles and improve operational efficiency. This feature minimizes delays and ensures faster reconciliation.

Straight-Through Processing (STP):

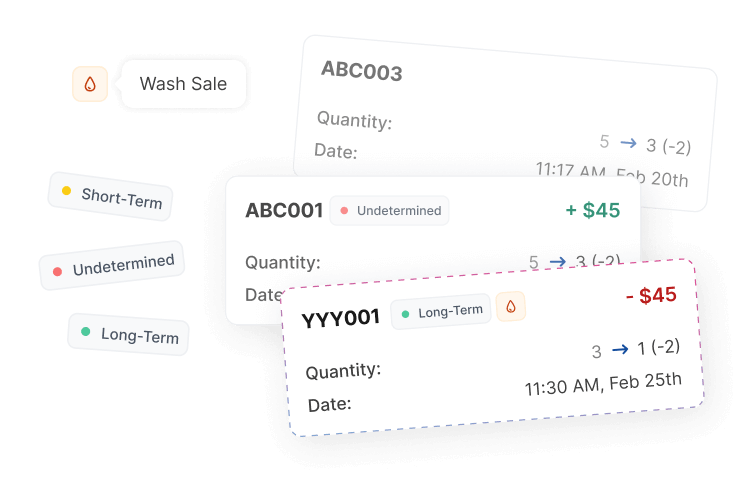

Automates trade validation, settlement, and reporting to eliminate manual errors and reduce delays. STP ensures seamless execution from trade capture to settlement.

Fractional Shares Trading Support:

Enable clients to trade fractional shares of stocks or ETFs with precision down to 0.0001 shares. Fractional trading allows investors to diversify portfolios at lower costs while retaining voting rights and dividends.

Order Routing with Risk Management (Middle Office):

Optimize execution by routing orders across multiple venues while mitigating risks through real-time margin calculations and exposure tracking.

Staging Blotter for Large Orders:

Break down large orders into smaller components to reduce market impact and optimize pricing using advanced algorithms or manual configurations.

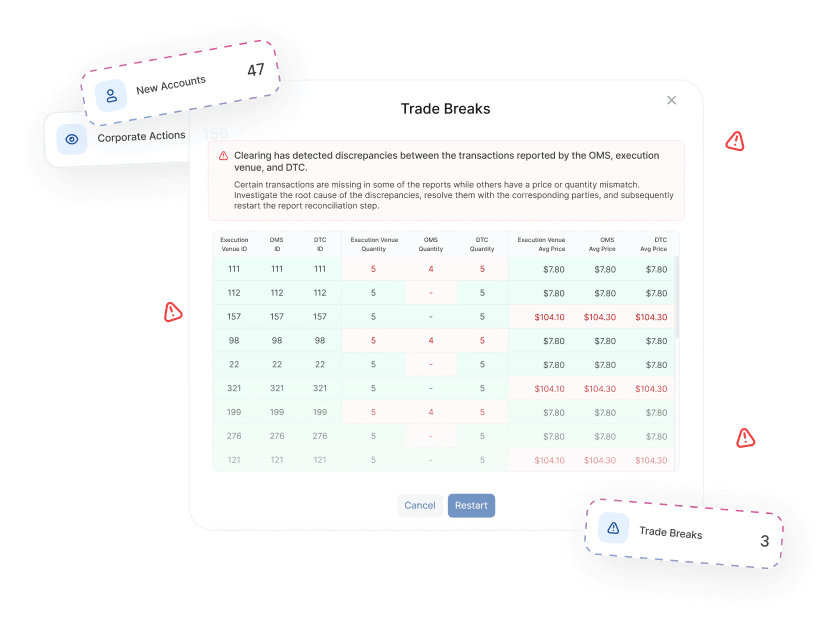

Risk Management & Compliance

Risk Management Tools:

Monitor intraday margin requirements, account exposure, and market risks in real-time to minimize potential losses while ensuring regulatory compliance.

Compliance Automation:

Fully compliant with FINRA/SEC regulations (including KYC/AML), day trading rules, OATS reporting requirements, Regulation-T margin calculations, and MiFID II standards.

Real-Time Buying Power & Margin Requirements:

Automatically calculate buying power and margin requirements in real time for portfolio management and risk mitigation.

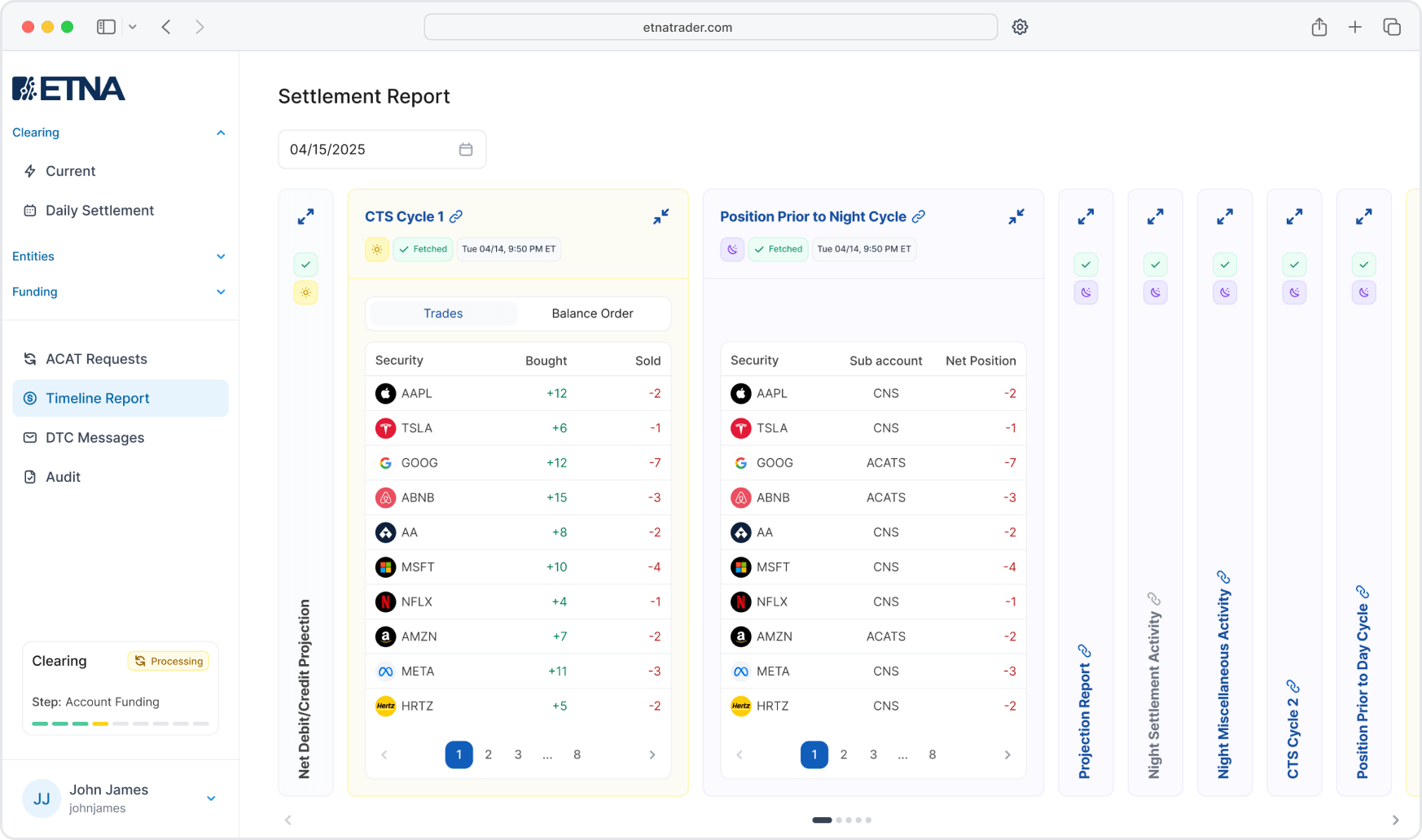

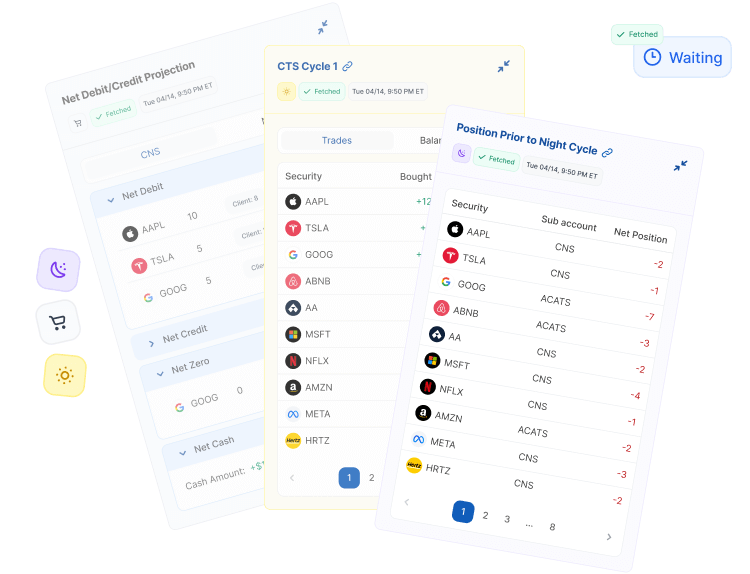

Client Management & Reporting

Omnibus Account Support:

Consolidate trades across multiple clients into a single account for simplified execution while maintaining privacy.

Customizable Reporting Tools:

Generate tailored reports for regulators or clients with advanced charting tools for asset allocation tracking.

Integrated Security Master Database:

Automates corporate actions lifecycle management with reconciliation capabilities to protect client assets.

Integration & Analytics

API Integration:

Robust APIs enable real-time data exchange between ETNA Clearing and your existing systems for workflow automation.

AI-Powered Analytics:

Leverage AI-driven insights for social sentiment tracking and portfolio optimization across client accounts.

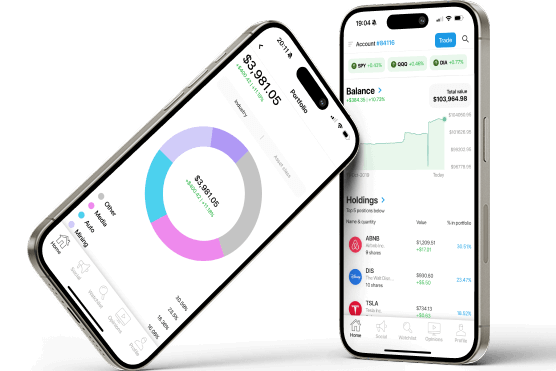

Mobile Accessibility:

Manage clearing operations on the go with mobile-friendly dashboards for iOS (iPhone/iPad/Apple Watch) and Android devices.

Multi-Custodian Flexibility:

Connect broker-dealers to multiple clearing firms simultaneously for diversified operations or add ETNA Clearing as a second solution for low-risk entry into self-clearing.

Multi-Execution Venue Support:

Seamlessly integrate with over 20 execution venues like DASH or Axos Clearing to optimize order routing across markets.

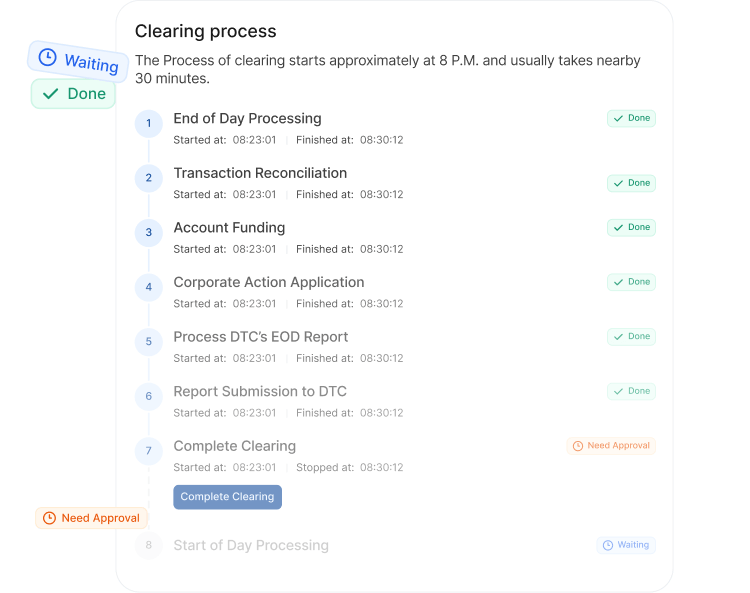

ETNA Clearing Processes Diagram

Account Opening Flow

account opening

form

(ETNA OMS)

request

(ETNA OMS)

KYC via LexisNexis

(Clearing Ul)

request

(Clearing Ul)

order

(ETNA OMS)

Account Funding Flow

banking

information

(ETNA OMS)

a deposit

(ETNA OMS)

approve

request

(OMS/Clearing)

sends transfer

to BMO Harris

Bank

performs

transfer

credits funds

to user

Whole-Share Trade Flow

(Exchange)

(ETNA OMS)

(ETNA Clearing)

Fractional Trade Flow

(ETNA Clearing)

(ETNA OMS)

(ETNA Clearing)

ACATS Flow

ACATS Request

(ETNA OMS)

approves

the request

(OMS/Clearing)

request to DTC

delivers assets

assets to user

Memo Seg Flow

transactions at EOD

transactions

to Mark customers' assets

Why Choose ETNA?

Validation at Every Stage

Ensure accuracy before clearing begins

to reduce errors and improve operational

efficiency around the clock

Capability

Accelerate settlement cycles

through instant processing

of trades

Integration

Seamlessly support fractional shares

alongside whole-share trading

for diverse portfolios

Trade cryptocurrencies alongside

traditional assets like equities or ETFs

while supporting multi-currency

transactions

*with multi-currency

(USD/CAD) & crypto support

Add ETNA Clearing as a secondary

solution or diversify operations across

multiple clearing firms

Connect seamlessly to over 20 execution

venues like Axos Clearing or DASH

Execution Venue for unified post-trade

operations

Tailor workflows, reporting templates,

APIs, dashboards, and fractional share

allocations to match your business

needs

Reduce operational costs through

automated processes that eliminate

redundancies

With over 22 years of experience

in fintech innovation, ETNA is trusted

by leading broker-dealers

Choose between server-based

or cloud-hosted solutions

for maximum flexibility

Handle high-volume trades

without compromising

performance or accuracy

Leverage AI-driven analytics for social

sentiment tracking and portfolio

optimization

all within a fully integrated ecosystem.

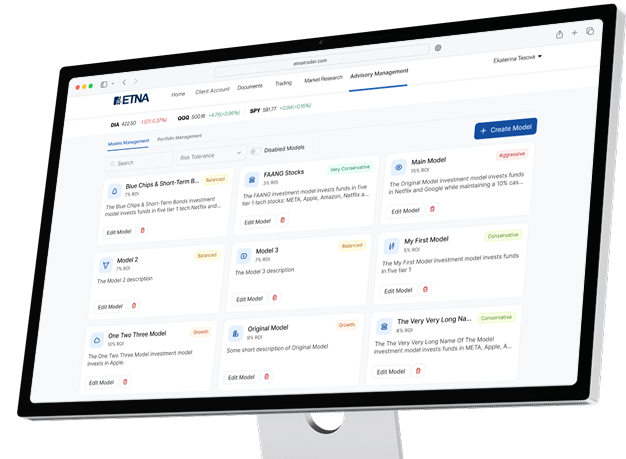

ETNA Platform Power: Fully Integrated Solutions

Portfolio management tools for rebalancing strategies and compliance tracking with client-specific reporting capabilities

Real-time trade validation paired with risk management tools ensures smooth post-trade operations across all asset classes while diversifying operational risks through multi-custodian setups

Enable clients to trade fractional shares of stocks/ETFs alongside cryptocurrencies while retaining dividends/voting rights

Provide clients access to trading tools anytime on any device—ensuring mobility without sacrificing functionality

Automate client onboarding processes while efficiently managing order routing and commission tracking

Fully customizable web-based terminals with advanced charting tools (50+ indicators), multi-leg options strategies builder, and watchlists/alerts customization

trading desks and back-office teams while delivering unparalleled efficiency.