Digital, online, connected – these new aspects of broker-dealers all correspond to the way a growing part of the market wants to handle its investments and trading. In 2018, the Pew Research Center found that millennials had become the largest living generation in the US, overtaking Baby Boomers. Millennials grew up with the Internet. Many of them also grew up with smartphones, taking instant access to information for granted. Moreover, they often value digital interfaces as a way of keeping a sales person at bay until they feel familiar enough with prospective transactions to make the most out of such a contact.

As markets and clients change, so must brokers. Millennials’ love for digital interactions mean that brokers must evolve to offer corresponding digital and mobile capabilities. Millennials also tend to have shorter attention spans. They have neither the time nor the inclination to do massive research on stocks or other investments. Nice trading platform is therefore no longer enough. Millennials expect their broker to offer quicker, digital counsel that is tailored to their risk tolerance and aligned with their investment goals. This trend is clearly driving decisions of well-known brokers like Schwab and Fidelity to focus their efforts on providing quality digital advice.

Having more clients may be an attractive idea. However, sales productivity is a priority for a stock brokerage firm. Millennials are more numerous, but individually they may have fewer assets to manage. After all, millennials were born in the 1980s or later. They are typically only in the early stages of their careers today. The way for brokers to engage with such ‘digital natives’ is by offering them what they want and used to – ‘digital advice’. The challenge though is how to do this fast and without overspending on time or money per client on IT, sales, and service.

Digital advisors, also known as robo-advisors, can provide an answer. These software-driven interfaces appeal to younger clients. Using smart automation, digital advisor platforms can combine personalized experiences for clients with operational efficiencies for brokerages. On the other hand, brokers should offer a consistent user experience across devices. These include PCs, smartphones, and wearables. They must also be aware of the point at which even an advanced digital platform will need human broker experts to step in, depending on the complexity of a client’s requirements.

Putting aside millennials, in a recent report PwC found that 69% of high net worth individuals (HNWIs) now use online or mobile banking solutions, while only a quarter of wealth managers actually offer digital channels and services beyond emails to interact with their clients.

This has created a “digital emergency” in a world of wealth management and introduced a whole new business niche – WeatlhTech.

In a fast-paced world we are living today, the speed of route to market – time from an idea to launch is crucial. White label software platforms might be a good solution to that problem.

“White label” is a popular topic nowadays, but what does it actually mean? White label product means that a product is produced by one company and then rebranded by another company to make it appear to be their own.

Most of the times in financial services white label software solutions, like a digital advisor platform or trading platform, is either developed by a software development firm with the necessary expertise and then licensed to financial services firms. Another scenario is when an online broker, or a digital advisor – in other words a financial software firm – creates a software platform to meet their own needs, uses it and then starts white labeling it to other similar businesses as an additional source of revenue and a market penetration strategy.

There are pros and cons for each approach. You might get a better integrated turnkey solution developed by a financial services firm, but most likely it will be less flexible and you will have to work on predefined terms. Platforms developed by technology firms have less limitations and more flexible for customizations, you can pick your own partners for market data and market intelligence.

The white label digital advisory platforms enable traditional financial advisors, wealth managers, and Registered Investment Advisors (RIAs) to offer digital advice and to automatically accompany clients in onboarding, portfolio rebalancing, and trade automation. Such platforms consist of a customer website, OMS and a robo-advisor back office technology. Look for functions like order execution, pre-and-post trade risk management, compliance, and reporting are also integrated.

Some of the platforms are designed to be “white label” which means they are completely rebrandable.

Industry observers like Accenture expect brokers and financial organizations to use digital advisors to broaden the markets they address. They can branch out to include segments that have been historically underserved. Yet they will continue to make the most of their traditional engagement models based on human professional investment and trading experts. Indeed, a robo-advisor analysis by Accenture states that 81% of clients for financial advisory services continue to rate face-to-face interaction as important. Also, 77% of wealth management clients trust their financial advisors and want their services for managing and growing their wealth.

This forecast is in line with the way smart systems and artificial intelligence are being used elsewhere. They help serve smaller accounts profitably and allow staff to focus on strategic opportunities. Using a white label digital advisor platform like ETNA Digital Advisor also lets brokers avoid the delay and risk of internal development, while still offering diverse possibilities to distinguish themselves in the market. Clients get the user experience they want and expect, while brokers remain on course for profitability and growth.

Contact ETNA to learn more about software solutions for digital and robo-advisors and get a free consultation.

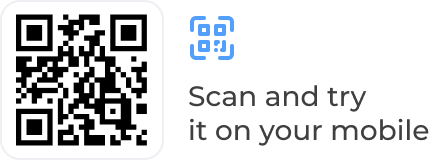

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

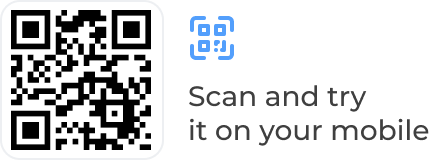

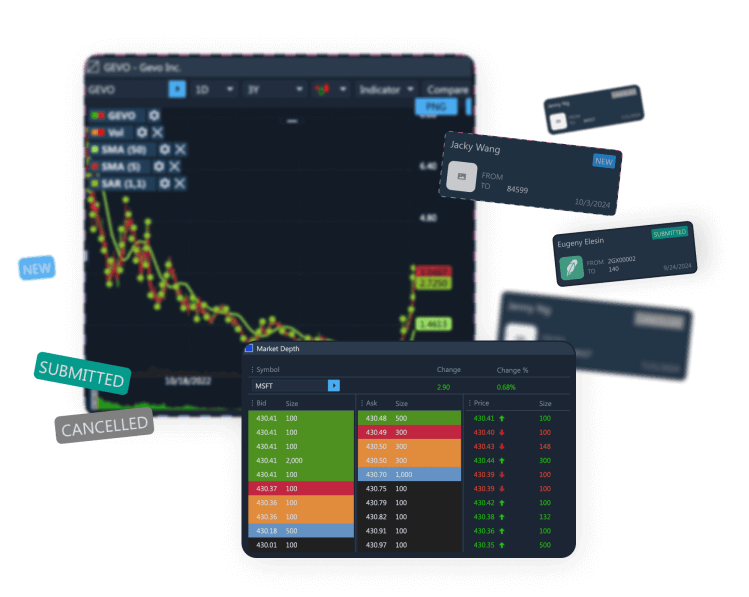

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.