Imagine you’re running a busy brokerage desk. It’s a fast-paced morning, traders are juggling tickers and clients, and suddenly a simple typo sends a 100,000 share order of AAPL to the market instead of 1,000. It sounds unlikely, right? Yet “fat finger” errors like these are a daily threat in modern trading, costing firms millions and shattering client trust in seconds.

Despite the digital sophistication of today’s financial markets, fat finger trades remain astonishingly common and costly. Global estimates suggest that fat finger errors account for as much as $3.5 billion in trades daily. Even the world’s largest institutions aren’t immune:

Even outside high finance, small misunderstandings like ordering the wrong stock because of a ticker typo can result in devastating consequences for retail investors and brokers alike.

At their core, fat finger errors are born from speed, pressure, and human fallibility:

The result? Orders that should never reach the market do sometimes triggering widespread volatility within seconds.

Financial firms worldwide are implementing layers of protection to curb fat finger risks:

But not all platforms make these safeguards easy or even available.

Recognizing both the prevalence and impact of fat finger errors, ETNA Trader equips brokers with robust, configurable controls to protect their business and their clients. The goal? Eliminate those “oh no” moments before they become headlines.

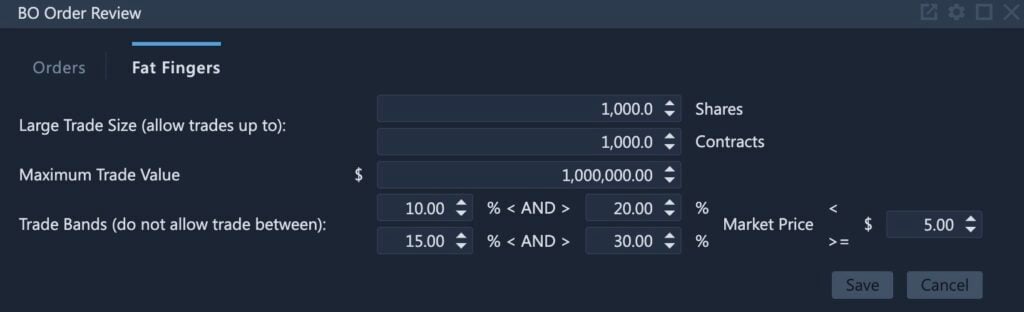

The term “fat finger” harks back to clunky phone keypads, but in trading, it means costly input accidents like entering 100,000 when you meant 10,000, or paying $250 instead of $25 a share. ETNA Trader gives brokers automated risk controls fat finger rules to block clearly erroneous trades from ever reaching the market.

1. Maximum Order Value

Set a ceiling on the total dollar (or CAD) amount for any single order. Perfect for catching “extra zero” mix-ups:

2. Maximum Order Quantity

Cap the sheer number of shares or contracts in any single order. Vital for those slip-of-the-finger disasters:

3. Trade Bands (Price Deviation)

Define an acceptable range above or below the current market price within which trades can be placed. Orders outside this “band” are immediately blocked:

Mistakes happen even to the most careful pros. Without protection, the consequences ripple across your business:

With ETNA Trader’s fat finger controls, brokers can:

Configuring robust fat finger controls in ETNA Trader is fast and intuitive:

Your platform is now shielded from the most common and dangerous input errors.

In a world where a single slip can move billions, robust safeguards are not just a “nice-to-have” they’re essential. Fat finger errors may be an old problem, but ETNA’s advanced, configurable rules ensure brokers and traders are equipped to meet it head on with speed, transparency, and control.

Ready to protect your platform and your clients? Contact your ETNA account manager or [email protected] to activate fat finger safeguards today.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.