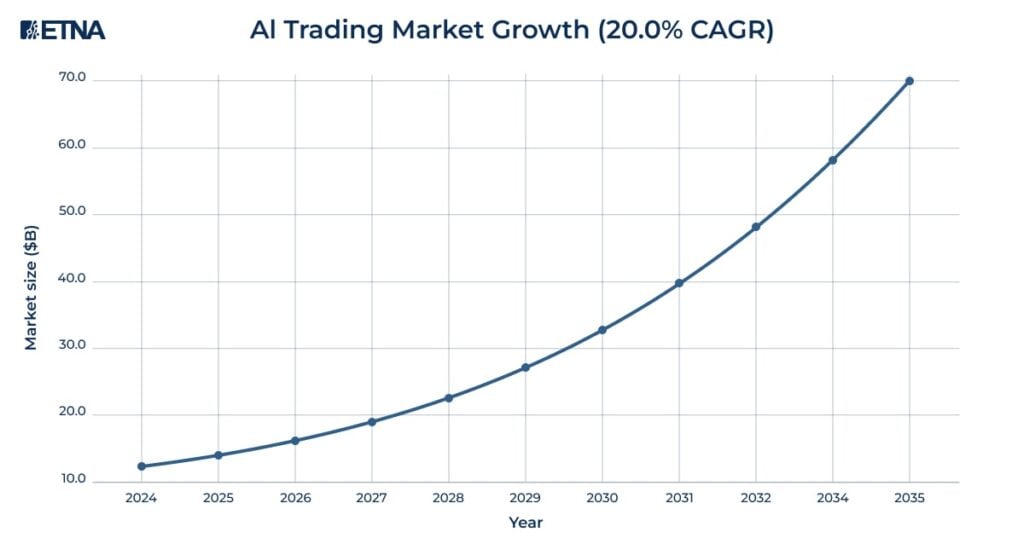

The convergence of artificial intelligence and financial markets represents one of the most significant technological disruptions in modern finance. As we advance through 2025, AI stock market prediction has evolved from experimental algorithms to a mission-critical infrastructure that’s fundamentally reshaping how broker-dealers forecast market movements, assess risk, and automate investment decisions. With the global AI trading platform market projected to reach $69.95 billion by 2034, growing at a remarkable 20.04% compound annual growth rate, the transformation of financial services is accelerating at an unprecedented pace.

The statistics paint a compelling picture of this revolution: artificial intelligence now drives approximately 70% of total trading volume in U.S. stock markets, while the predictive AI market for stock trading alone is expected to surge from $831.5 million in 2024 to $4.1 billion by 2034. This represents far more than incremental improvement it signals a fundamental reimagining of how financial institutions operate, compete, and deliver value to their clients.

For broker-dealers and registered investment advisors (RIAs), the implications extend well beyond simple automation. AI is transforming the very foundations of investment decision-making, from portfolio construction and risk management to client engagement and regulatory compliance. The technology promises not just efficiency gains, but entirely new capabilities that were previously impossible at scale.

Key Takeaways

Market Leadership: Trade Ideas’ Holly AI generates 61% returns vs S&P 500’s 32%

Accuracy Rates: Neural networks achieve 83% directional prediction accuracy

Cost Impact: AI reduces compliance operational costs by 60%

Adoption Scale: AI processes over 20 million financial documents daily

How Does Artificial Intelligence Stock Prediction Actually Work? The Technology Behind AI Stock Price Prediction Core Technologies:

Neural Networks (LSTM): Process sequential time-series data for price movement analysis

Natural Language Processing: Analyzes earnings calls, SEC filings, news, social media sentiment

Reinforcement Learning: Continuously adapts strategies based on market feedback

What Data Do AI Predictors Analyze? Data Processing Scale:

Danelfin: 10,000 features per stock daily (600+ technical indicators, 150 fundamental metrics)

Sentieo: 20 million financial documents from 64,000 companies daily

Data Categories:

Traditional financial data (price, volume, earnings)

Alternative sources (satellite imagery, shipping patterns, patents)

Sentiment analysis (news, social media, analyst reports)

Macroeconomic indicators (rates, inflation, employment)

Is AI Stock Market Prediction Accurate? Setting Realistic Expectations Accuracy Statistics:

Minor corrections (5-10%): 80% prediction accuracy

Major crashes (>20%): 37% prediction accuracy

Directional prediction: 83.43% average accuracy across 7 global indices

FTSE 100: 93.48% directional accuracy

Performance Benchmarks:

Holly 2.0: 33% annual returns

Danelfin strategy: 263% returns (2017-2024) vs S&P 500’s 189%

The Best AI Stock Prediction Apps & Tools in 2025 1. ETNA Trader Best for Building a Custom AI Stock Predictor Key Features:

Multi-data provider integration capabilities

Customizable algorithm framework (regression to neural networks)

Risk management integration with regulatory compliance

Comprehensive backtesting with scenario analysis

Multi-asset trading (equities, options, fixed income, alternatives)

2. TrendSpider Best for AI-Powered Technical Analysis & Prediction AI Technology:

AI Strategy Lab: Multiple algorithms (Naive Bayes, Logistic Regression, Random Forest)

Sidekick AI: Conversational chart analysis and real-time insights

Pattern Recognition: Automated identification of chart patterns, trendlines, and Fibonacci levels

Core Capabilities:

Multi-timeframe analysis synchronization

Custom prediction model development

Real-time alerting system

3. Trade Ideas Best for AI-Generated Day Trading Predictions Holly AI System:

Holly Classic: 70 strategies, 60%+ win rates, 2:1 risk-reward ratios

Holly 2.0: 33% annual returns, aggressive trading approach

Holly Neo: Real-time pattern recognition for intraday trading

Performance Data:

Millions of daily backtests on 8,000+ U.S. stocks

60+ algorithmic strategies

3 consecutive years outperforming S&P 500

4. Danelfin Best for Simple AI-Based Stock Scores AI Technology:

900+ fundamental, technical, and sentiment data points daily

10,000 daily indicators across U.S. and European stocks

Simple 1-10 AI Score for 3-month outperformance probability

User Experience:

Explainable AI with decision transparency

Multiple investment timeframes

Free tier with basic functionality

How to Choose the Right AI Stock Prediction Tool for You For Developers vs. For Investors: What’s the Difference? Developer-Focused Platforms (ETNA Trader):

Custom AI model creation flexibility

Significant technical expertise required

Ideal for larger broker-dealers with tech teams

Investor-Focused Solutions (Danelfin):

Ease of use and immediate applicability

No deep technical knowledge required

Suitable for smaller firms and practitioners

Hybrid Approaches (TrendSpider):

Pre-built AI capabilities with customization options

Appeals to firms wanting analysis tools with strategy development

Key Features to Look for in an AI Stock Predictor Essential Criteria:

Data quality and breadth (traditional + alternative sources)

Transparency and explainability for regulatory compliance

Integration with existing custodial/portfolio management systems

Verifiable performance track record across market conditions

Robust audit trails and compliance monitoring

Understanding Costs and Subscription Models Pricing Structure:

Entry-level: Free tiers (Danelfin) to basic retail plans

Enterprise: Tens of thousands annually

Performance-based: Success fees aligning vendor-client incentives

Implementation: Training, integration, and maintenance costs

The Pros and Cons of Using AI for Stock Prediction Advantages of AI Stock Prediction

Speed/Scale: Analyze thousands of securities simultaneously

Pattern Recognition: Detect complex correlations across variables/timeframes

Emotion-Free Decisions: Eliminate psychological biases (fear, greed)

Continuous Learning: Refine models based on market outcomes

Cost Efficiency: Automate research/analysis functions

Limitations and Risks

Black Swan Events: Struggle with unprecedented market disruptions

Data Dependency: Only as good as training data quality

Model Opacity: “Black box” challenges for compliance/communication

Overfitting Risk: Over-specialization reduces adaptability

Systemic Risk: Correlated behavior amplifying volatility

Regulatory Challenges: Evolving governance/bias prevention requirements

Regulatory Landscape and Compliance Challenges Current Regulatory Framework

U.S. Regulation:

FINRA Notice 24-09: AI tools must be supervised like other systems

SEC AI Task Force: Accelerating responsible AI integration

Technology-neutral approach: Existing rules apply to AI systems

Compliance Requirements:

Supervision and oversight policies at enterprise/individual levels

Comprehensive audit trails and decision-making logs

Risk management for cybersecurity, bias, operational resilience

Marketing content meeting regulatory standards

Emerging Challenges

Algorithmic Bias: Fairness testing and bias detection requirements

Market Manipulation: Concerns about coordinated trading strategies

Systemic Risk: Concentration of AI decision-making requiring enhanced monitoring

Impact on Broker-Dealer Operations Transforming Portfolio Management

Automated Rebalancing: Continuous monitoring and optimization

Multi-Criteria Optimization: Hundreds of variables (risk, ESG, taxes)

Dynamic Risk Management: Real-time exposure monitoring with automatic adjustments

Enhancing Client Service and Engagement

Personalized Advice: Individual profiles, goals, risk preferences

24/7 Support: AI chatbots for portfolio/market queries

Predictive Needs: Anticipate liquidity requirements and preference changes

Operational Efficiency Improvements

Document Processing: Automated classification and information extraction

Compliance Automation: Violation detection, report generation, audit trails

Cost Reduction: 60% reduction in compliance operational costs

The Future of AI Stock Market Prediction Emerging Technologies and Capabilities

Quantum Computing: Exponentially larger datasets and complex algorithms

Advanced NLP: Real-time financial document analysis and misconduct detection

Autonomous Trading: Integrated ecosystems with minimal human intervention

Democratization of AI Tools

Smaller Firm Access: Cloud-based platforms leveling competitive field

No-Code Development: Natural language and drag-and-drop interfaces

Cost Reduction: Declining implementation costs for all firm sizes

Integration with Emerging Market Structures

DeFi Integration: Decentralized finance market analysis and participation

ESG Investing: Environmental, social, governance factor integration

T+0 Settlement: Faster decision-making for real-time settlement

Final Word: Enhancing Your Strategy with AI Stock Prediction Strategic Imperatives:

Market Reality: 70% of U.S. trading volume driven by AI, $69.95B market by 2034

Competitive Advantage: Early adopters establishing significant market position

Implementation Success: Requires careful planning, governance, regulatory compliance

Hybrid Approach: Combine AI analytical power with human insight and oversight

The question is no longer whether to adopt AI, but how quickly and effectively firms can integrate these technologies for superior client outcomes.

Frequently Asked Questions (FAQ) What is the most accurate AI stock predictor?

Trade Ideas Holly AI: 61% returns vs S&P 500’s 32%

Neural Networks: 83% directional prediction accuracy

Performance varies: Market conditions and prediction timeframes impact accuracy

Can AI truly predict stock prices?

Pattern/Direction Strength: 80% accuracy for minor corrections, 37% for major crashes

Limitation: Best viewed as analytical enhancement tool, not perfect prediction system

Timing Challenges: Struggles with unprecedented events and precise timing

What is the best free AI stock predictor?

Danelfin: Comprehensive free tier analyzing 900+ data points daily

Performance: 263% returns since 2017 vs S&P 500’s 189%

Coverage: Thousands of U.S. and international stocks

Is using AI for stock market prediction legal?

Legal Status: Yes, with existing financial regulation compliance

Requirements: Proper oversight, recordkeeping, risk management procedures

Restrictions: No market manipulation, transparency in decision processes