Day trading remains a high-velocity segment of the US equities market, and broker-dealers must ensure strict compliance with FINRA’s pattern day trader (PDT) rules. Understanding these regulations is crucial, not only for regulatory compliance but also for protecting your firm and its clients from unnecessary risk. Here’s an in-depth look at what constitutes a pattern day trader, the rules that govern them, and what broker-dealers need to know for robust compliance.

Under FINRA Rule 4210, a pattern day trader is any customer who executes four or more day trades within five business days in a margin account, provided those day trades represent more than 6% of the customer’s total trades in that same period.

Example:

If a client makes 60 trades in five business days, and at least 4 of those are day trades (and those day trades are more than 6% of total trades), they are classified as a pattern day trader.

Broker-dealers are also empowered to designate a customer as a PDT if they have a reasonable basis to believe the client will engage in pattern day trading, such as after providing day trading training or observing trading behavior.

FINRA’s PDT rules are designed to:

Pattern day trader rules are a cornerstone of FINRA’s approach to managing risk in the US securities markets. Broker-dealers must not only understand and enforce these rules but also proactively educate clients and maintain robust compliance systems. By doing so, you protect your firm, your clients, and the integrity of the markets.

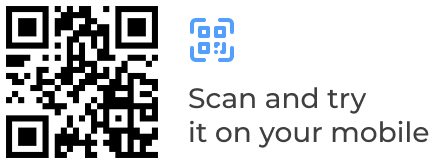

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

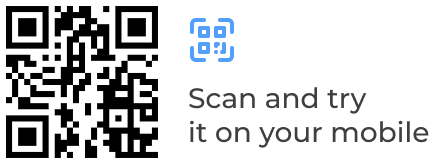

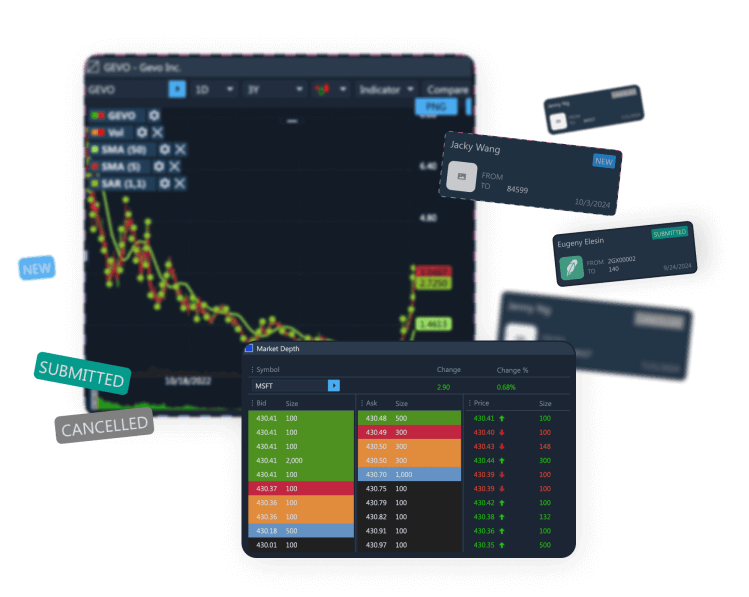

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.