Advisory practices are more complex than ever: multi-generational clients, multi-asset portfolios, tighter regulations, and nonstop digital expectations. To scale without burning out, you need a carefully chosen stack of financial advisor tools that actually work together – not just a patchwork of logins. In 2026, that stack goes well beyond a basic CRM, planning software, and trading screen.

You now have to think in terms of integrated financial advisor technology: AI-powered advisor tools, mobile advisor and client apps, specialized financial planning technology, tax and estate planning technology, and platforms that support investing beyond equities, including crypto, foreign equities, and alternatives.

This article walks through 14 essential advisor tools, grouped into categories, with practical notes on who they fit and how they interact in a real-world practice.

A modern CRM is the foundation of any scalable advisory business. It’s where leads are tracked, meetings are scheduled, tasks are assigned, compliance notes are stored, and client history is searchable in seconds. Strong CRMs have become central financial advisor technology, not just digital Rolodexes. Many leading CRMs now embed AI to suggest next actions and offer full-featured mobile apps so you can work from anywhere.

CRM-based financial advisor tools commonly support:

Salesforce is a CRM used across many industries, including wealth management and financial services.

A regional RIA might use Salesforce to create custom objects for households and relationships, build workflows for onboarding, and connect Salesforce to other systems via integrations and APIs.

Add-ons such as Salesforce Financial Services Cloud (purpose-built for financial services) and Salesforce’s AI features (including Einstein/Next Best Action) can help surface insights and recommended actions inside CRM workflows, making Salesforce a flexible advisor tool for larger firms.

Redtail CRM is tailored specifically for financial professionals, making it a common choice among independent RIAs and smaller broker-dealers. It emphasizes usability: contact and household records, task management, workflows, and timeline-based notes.

Redtail offers integrations with a range of third-party tools used by advisors, including planning software such as eMoney and MoneyGuide. It also supports CRM integrations with RightCapital (primarily for household/contact sync) via RightCapital’s integration feature.

Financial planning has moved from simple calculators to integrated, ongoing planning experiences. Clients often expect you to navigate retirement income, Social Security, education planning, insurance, tax planning technology, and estate planning scenarios in a single, coherent plan, and modern tools increasingly leverage AI to speed analysis and scenario-building.

Modern financial planning technology typically supports:

| Key Feature | Pricing Model | Target Advisor |

|---|---|---|

| RightCapital – Planning platform with tax-strategy tools (including Roth conversions tied to tax-bracket thresholds) and a dedicated student-loan analysis module. | Subscription per advisor; tiered based on features and number of clients. | Growth-focused RIAs and planners who want visually engaging, tax-aware planning. |

| MoneyGuide – Goal-based planning with client-friendly interfaces and interactive tools like Play Zone® and “what-if” scenario exploration. | Subscription per advisor or enterprise pricing for larger firms. | Advisors who emphasize goals and behavior, and want lightweight, collaborative plans. |

| eMoney – Planning plus a client portal experience, including account aggregation and a secure document vault. | Subscription per advisor; enterprise options and add-ons available. | Firms wanting financial planning technology with strong client-portal and data-aggregation capabilities. |

RightCapital includes tax-strategy modeling (including Roth conversion strategies that ‘fill up’ tax-bracket thresholds) and a Social Security Optimization module; outputs are designed to be reviewed with clients.

For an advisor targeting young professionals with student loans, RightCapital’s dedicated student-loan analysis module can be a meaningful differentiator.

MoneyGuide emphasizes goal-based planning and a straightforward planning workflow. Its Play Zone® feature lets clients and advisors vary plan elements like retirement age, savings, or goals and immediately see the impact.

It can fit firms that want scalable, repeatable planning conversations delivered in person or via remote meetings.

eMoney combines planning with a client portal experience that can include account aggregation, goal tracking, and a secure document vault.

For firms that want planning, aggregation, and a portal experience in one system, eMoney can function as a central hub of financial planning technology.

Once the plan is set, implementation and monitoring can become complex across accounts, tax buckets, and asset types. Advisors may work across:

Advisors are also increasingly using alternative & predictive environments such as factor models, risk analytics, and scenario engines to inform investment decisions.

Modern investment advisor tools must handle performance reporting, portfolio analytics, drift monitoring, rebalancing, and order execution – ideally in a unified, compliant workflow.

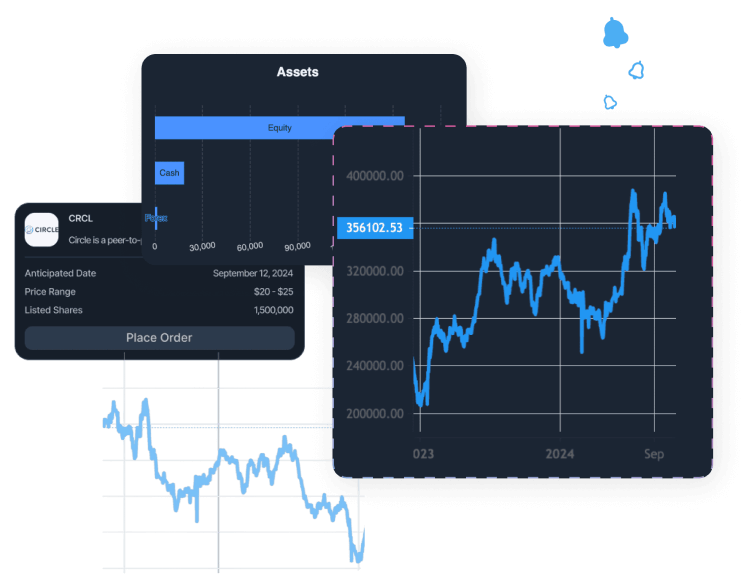

SS&C’s Black Diamond Wealth Platform provides portfolio management and client-ready reporting, including an online client experience and mobile access for authorized users.

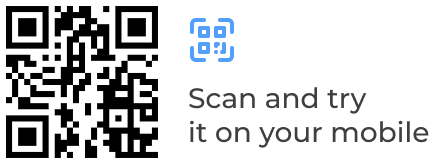

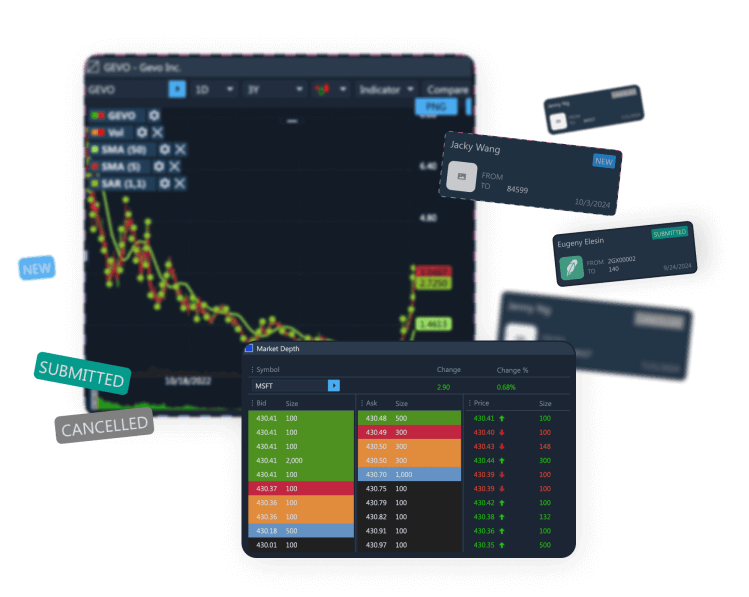

ETNA Trader (ETNA Trader Suite) is a white-label trading platform designed for broker-dealers, fintechs, and digital-advisor use cases. ETNA’s materials describe support for trading stocks (including fractional stocks), options (including multi-leg strategies), mutual funds, IPOs, and UITs, along with real-time market-data capabilities and APIs for integration.

From an operations standpoint, ETNA offers APIs and integration capabilities so firms can embed trading into internal dashboards or client-facing portals.

A firm might, for example, connect ETNA to upstream portfolio-model workflows and downstream reporting using ETNA’s APIs and integrations, so that trading and reporting systems stay in sync.

Smooth operations are what allow an advisory firm to scale while maintaining service quality. Beyond client-facing tools, you need systems for billing, scheduling, document workflows, and compliance – all integrated into your broader financial advisor technology environment.

Key needs include:

Billing systems calculate advisory fees, generate invoices, track receivables, and produce reports for compliance and internal management.

Orion provides a wealthtech platform that includes billing tools to help firms calculate advisory fees, manage billing data, and generate billing outputs; implementations commonly rely on custodial/account data feeds integrated into Orion to support reconciliation and audit readiness.

Scheduling is a deceptively high-friction part of an advisor’s day. Back-and-forth emails can slow onboarding or annual reviews.

Calendly automates booking by letting clients pick time slots that match your availability, synced with your calendar. You can create different event types – discovery calls, plan reviews, prospect meetings each with custom durations, locations (Zoom, phone, office), and intake questions.

Calendly’s native Salesforce integration can automatically create and update Salesforce records as invitees schedule meetings.

Client retention depends on frequent, clear, transparent, and compliant communication. Clients expect mobile access, timely updates, and educational content on topics such as cryptoassets, tax planning, and estate planning.

Effective communication advisor tools support:

AI-powered personalization is increasingly used to tailor these communications and educational experiences to each client’s goals, preferences, and risk profile.

Client portals often come bundled with planning or reporting systems such as eMoney or Black Diamond. These portals can provide:

Advisors now serve clients across the country – sometimes across borders – on an ongoing basis. Video calls and screen sharing are standard expectations.

Zoom is a commonly used conferencing tool across many wealth firms. Advisors use it for discovery meetings, plan presentations, and quarterly reviews, often pairing it with scheduling automation (for example, Calendly can automatically generate Zoom links for booked meetings).

AI is rapidly reshaping how advisors analyze data, engage clients, generate recommendations, and support compliance. Rather than replacing advisors, AI-powered financial advisor technology can act as a force multiplier – surfacing insights and summarizing documents faster than manual processes.

Below are two AI-focused advisor tools gaining traction.

FP Alpha uses AI to analyze client documents – tax returns, wills, trusts, and insurance policies – and surface planning opportunities.

Catchlight uses data enrichment and an AI scoring model (Catchlight Score) intended to predict a prospect’s likelihood to convert, helping advisors prioritize outreach.

Catchlight also publishes integrations with advisor CRMs, including Salesforce and Redtail, so enriched fields and scoring can be available where teams work day-to-day.

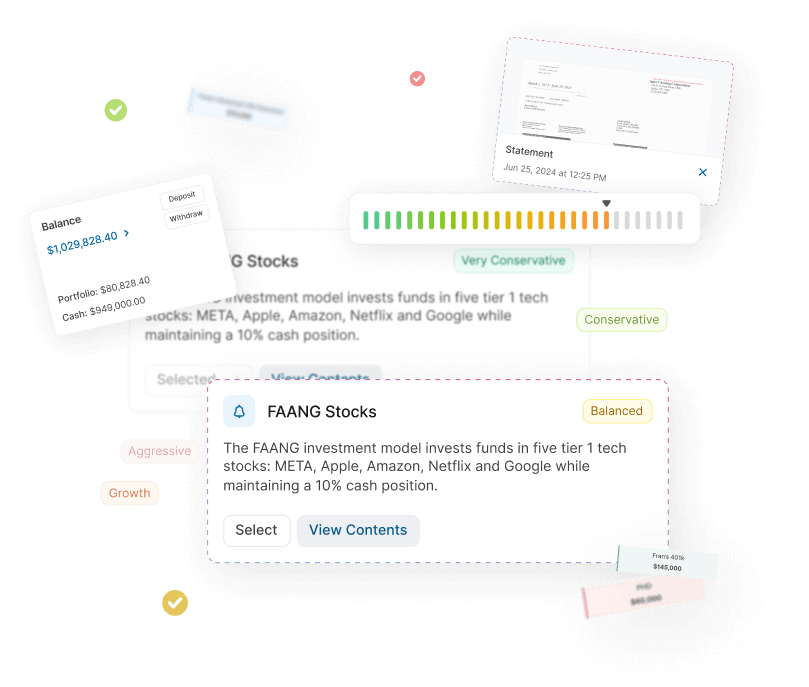

Clients increasingly experience your firm via their smartphone. Advisors also need mobile access to contacts, notes, and tasks when traveling, in client offices, or at conferences. A mobile-first mindset is no longer optional.

Strong mobile advisor tools deliver:

Many platforms (Salesforce, Redtail, eMoney, Black Diamond, ETNA) offer mobile experiences. Here’s one example that puts mobility front and center.

Wealthbox CRM offers a companion mobile app for iOS and Android.

Wealthbox’s mobile app is positioned to extend core CRM workflows – such as task management, calendar events, and opportunity/pipeline management to mobile.

Tax considerations drive many of the most valuable planning decisions: Roth conversions, harvesting gains or losses, asset location, and charitable giving. Proactive tax planning – done year-round, not just in April – can materially affect after-tax outcomes for clients.

Specialized tax planning technology tools can:

Holistiplan is a tax planning tool designed for advisors. You upload a client’s 1040 tax return; the system parses it and produces a summary and a scenario-analysis workflow to help identify tax-planning opportunities.

With hundreds of financial advisor technology solutions on the market, picking the right mix can feel overwhelming. Start with your firm’s size, specialization, and client promises: a solo planner serving tech employees will prioritize different tools than a multi-office RIA focused on retirees or business owners.

Evaluate each candidate by:

Before buying or switching financial advisor technology tools, ask yourself these five questions:

Treat your stack like a living system. Review it annually, retire what’s unused, and make careful additions where they truly improve client experience and internal execution.

Technology is no longer a sidecar to an advisory firm – it is a central investment that shapes client experience, compliance posture, and profitability. A future-ready stack blends CRM, planning, portfolio management, trading, AI-powered advisor tools, mobile apps, and specialized tax- and estate-planning technology into a cohesive whole. The call to action is simple: audit your current stack, identify the biggest gaps relative to your ideal client experience, and build a deliberate roadmap to close them over the next 12–24 months.

Infrastructure matters behind the scenes as much as the front-end tools your team touches, and platforms such as ETNA can provide enabling trading infrastructure while leaving each firm free to assemble the right mix of applications for its unique advisory model.

New RIAs should prioritize a compliant CRM, comprehensive planning software, a portfolio management/reporting platform appropriate for their needs, and reliable communication tools (email, e-signature, video conferencing). From there, add financial planning technology for tax and estate depth, plus scheduling and billing systems as your client base grows.

AI can enhance financial advisor technology by automating data extraction, surfacing planning opportunities, summarizing meeting notes, and prioritizing leads. Tools like FP Alpha and Catchlight can be integrated into workflows to save time and expand the range of analyses advisors can deliver.

Many firms combine best-of-breed investment advisor tools (for trading and reporting) with specialized planning platforms. All-in-one systems can be simpler but may be less deep in certain areas; separate tools require more integration work but can provide stronger capabilities in each domain.

Very important. Clients increasingly expect to review accounts and documents on their phones, and advisors often need mobile access to contacts, tasks, and notes.

Start with your must-have use cases, then match them to specific financial advisor tools instead of buying broad suites you won’t fully use. Pilot tools with a subset of users, measure time saved or workflow improvements, and renegotiate or switch vendors if usage and value don’t justify the cost.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.