Practical advice for thriving in the evolving broker-dealer landscape and improving technology selection.

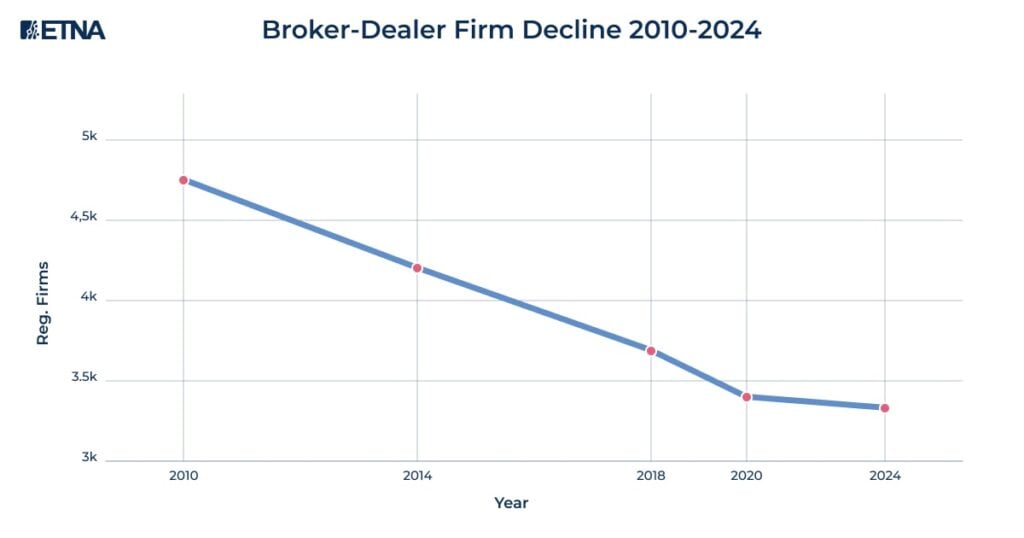

A broker-dealer is a financial firm or individual authorized to buy and sell securities both for clients and for itself. The broker-dealer’s dual role is central to the financial ecosystem, providing essential services like trade execution, market making, underwriting, and liquidity provision. In 2025, industry numbers reflect consolidation: FINRA-registered broker-dealer firms have declined by 30% since 2010 (to 3,340 firms), yet assets have reached $6.4 trillion, showing scale and resilience.

The number of FINRA-registered broker-dealer firms has declined by 30% from 2010 to 2024, reflecting significant industry consolidation

Objective: This guide empowers finance professionals to understand broker-dealer definitions, explore modern business models, review industry trends, and apply technology selection best practices to thrive in today’s market.

Broker-dealers combine two central functions:

Acting as both agent and principal brings flexibility but also unique regulatory and ethical challenges.

| Aspect | Broker | Dealer |

| Role | Agent (client intermediary) | Principal (trades own account) |

| Compensation | Commission; service fees | Bid-ask spread; trading gains |

| Fiduciary Duty | Yes, must act in the client’s best interest; Reg BI | No fiduciary duty; must disclose conflicts |

| Example Transaction | Executes the client order at the best price | Sells bond from inventory to the client |

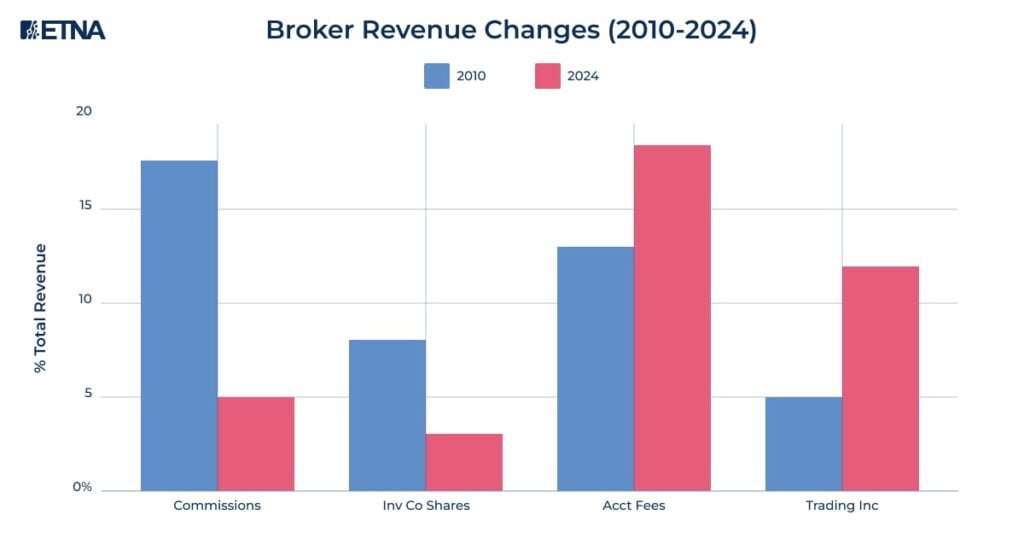

Modern broker-dealers have shifted from commission-heavy models to fee-based and trading-oriented income streams.

Revenue model transformation showing the shift from commission-based to fee-based and trading income models in the broker-dealer industry from 2010 to 2024

Dealer markets primarily OTC enable continuous liquidity by allowing participants to trade directly with dealers who own inventory. Dealers quote bid and ask prices, profiting from spreads and supporting less liquid assets (bonds, derivatives). Rapid digitalization, automated systems, and AI have narrowed spreads and raised efficiency, dramatically shaping the market landscape.

Regulatory oversight shapes every aspect of broker-dealer operations, placing a strong focus on investor protection, transparency, and ethical conduct.

Recent priorities:

Key ethical challenges in broker-dealer practice:

Regulation Best Interest requires clear disclosure and processes to ensure client priorities.

Successful entry into the broker-dealer industry demands financial expertise, compliance proficiency, and now technology fluency.

| Position | Average Salary (2025) |

| Entry-level Stock Broker | $54,045 |

| Early Career (1–4 years) | $63,679 |

| Mid-career Broker | $63,486+ |

| Average Broker Dealer | $63,500 |

| Vice President | $144,230 |

| Chief Compliance Officer | $280,938 |

| Trader | $75,102 |

| Compliance Officer | $95,000–$125,000 |

Industry trends:

Broker-dealers remain vital for liquidity, price discovery, and capital access in financial markets. The 2025 landscape rewards firms embracing automation, AI, consolidation, and compliance. Success depends on:

Industry consolidation, fee-based advisory growth, and AI innovation will continue to reshape the broker-dealer role. For aspiring professionals and established firms, continuous learning, strategic tech selection, and robust ethics offer the surest route to thriving in the new broker-dealer environment.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.