On April 15th, every investor faces the task of filing tax returns for their investment earnings. Accurate data is crucial for a smooth tax filing process. Etna platform can help you streamline this task and save valuable time. Before we dive in, let’s explore the different types of taxes you might encounter.

Capital gains tax. This tax impacts investors annually on profits from asset sales such as stocks, bonds, real estate, and collectibles. Rates are based on holding period, favoring lower rates for long-term investments. Higher income leads to higher CGT rates. Capital gains income is reported on the 1099-B form.

Dividend tax. Investors encounter Dividend Tax on company earnings distributed to shareholders, comprising Non-Qualified and Qualified Dividends. Non-Qualified Dividends are subject to standard income tax rates, whereas Qualified Dividends face lower rates akin to long-term capital gains. Non-Qualified Dividends are reported in Box 1 of the 1099-DIV form, while Qualified Dividends are listed in Box 1b.

Interest tax. This tax affects investors on interest income from investments like savings accounts, bonds, and certificates of deposit. It is levied annually at the investor’s standard income tax rate, with implications varying based on their tax bracket and total interest earned. Reported on the 1099-INT form.

The ETNA platform diligently monitors every transaction, dividend, and interest income, ensuring all crucial data is readily available at tax time. Discover the benefits of leveraging our platform:

Accurate data for taxation. ETNA ensures the precise reporting of Capital Gains, Dividends, and Interest. Our platform offers detailed reports distinguishing between short-term and long-term transactions and maintains exhaustive records of Dividends and Interest, covering everything from qualified stock dividends to bond interest.

Time savings. During tax season, ETNA’s reporting capabilities significantly simplify your filing process. Say goodbye to sifting through paperwork or manually consolidating data from various sources. With ETNA, you can generate a comprehensive report containing all necessary information, making the process smoother for you and your tax advisor.

Ensuring compliance. Our platform provides reports in the exact format required for tax filing, including necessary forms like 1099-B, 1099-DIV, 1099-INT, 1099-MISC and 1099-OID ensuring compliance with tax laws.

Reduced error potential. Through automated calculations, ETNA minimizes the likelihood of errors in your tax computations.

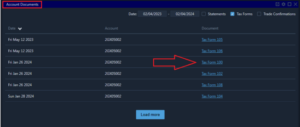

To access your tax documents, simply navigate to the “Account Documents” widget on our platform. Here, you’ll find an extensive list of your reports. Select the report you need, open it, and download it directly to your device.

By harnessing the power of ETNA, navigating the complexities of tax season becomes significantly less daunting, allowing you to focus more on your investments and less on paperwork.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.