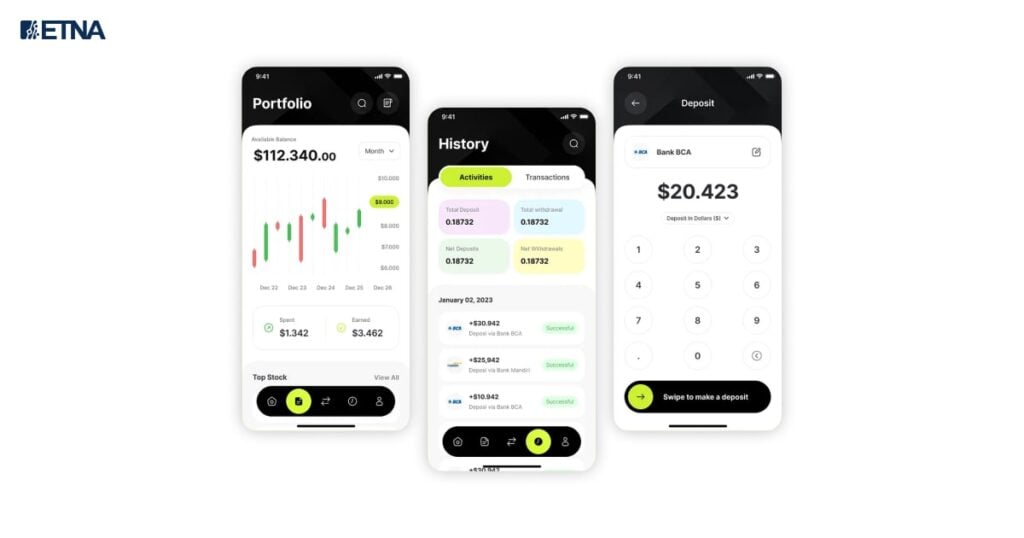

Mobile user interface of a beginner-friendly stock trading app showing portfolio, transaction history, and deposit screens

Trading is complex choosing the right app immediately simplifies the learning curve and helps beginners avoid costly mistakes. In today’s world, the best app to learn trading for beginners means finding simple tools, built-in education, and zero-risk practice. Over 75% of trades now happen on mobile apps globally.

Top 3 Recommended Apps for Beginners

Mobile user interface of a beginner-friendly stock trading app showing portfolio, transaction history, and deposit screens

Ranking Criteria Used:

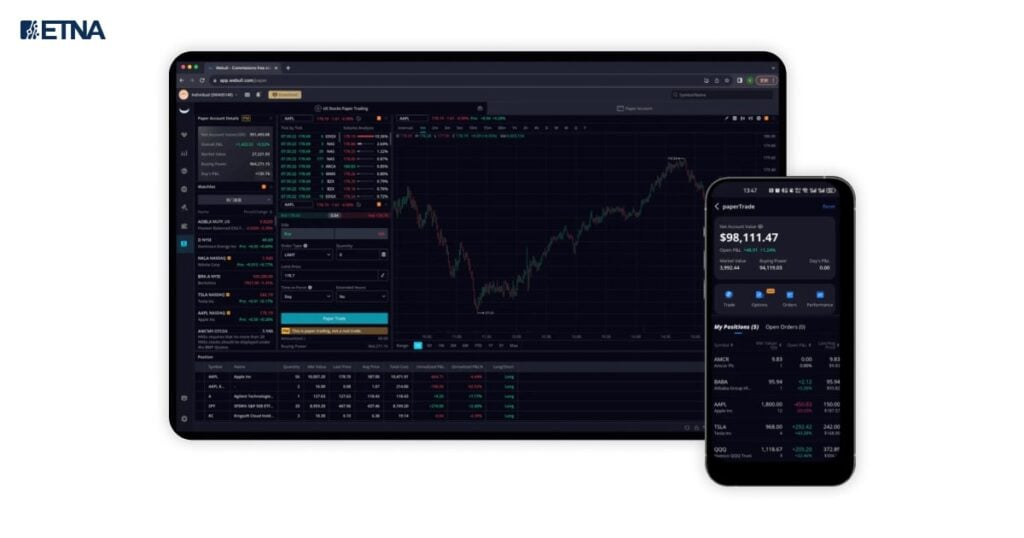

Webull paper trading simulator dashboard showing detailed trading interface for beginners on desktop and mobile apps

Knowing what features matter most helps new traders pick the right apps to learn investing.

| Fee Type | Traditional Brokers | Modern Free Apps |

| Stock Commission | $5 – $10 per trade | $0 |

| ETF Commission | $5 – $10 per trade | $0 |

| Options Contract Fee | $0.50 – $1.00 per contract | $0 – $0.65 per contract |

| Account Maintenance Fee | $25 – $100 annually | $0 |

| Minimum Deposit | $500 – $2,000 | $0 – $100 |

Note: Fees listed as of Q4 2025. Subject to change.

Actionable bullet-point reviews. Quick features checklist:

Pros

Cons

Pros

Cons

Pros

Cons

Pros

Cons

Pros

Cons

Pros

Cons

Pros

Cons

Never start with money you cannot afford to lose. Always master paper trading first.

After a comprehensive analysis of educational resources, fee structures, user experience, and learning support, the verdict is clear: the best app for learning trading balances comprehensive education with zero-risk practice opportunities. The platforms that excel in both dimensions ETNA’s Paper Trading Platform, Fidelity, Charles Schwab’s thinkorswim, and Webull provide the strongest foundations for long-term investing success.

For absolute beginners seeking the best app to learn the stock market for free, the choice depends on your specific learning style and goals:

Choose ETNA Paper Trading Platform if you want professional-grade trading education with institutional-quality tools, customizable learning environments, and realistic market simulation across multiple asset classes. The platform’s comprehensive approach, used by universities and broker-dealers worldwide, provides unmatched preparation for serious trading careers.

Choose Fidelity if you want the most comprehensive educational resources combined with seamless transition to live trading within a trusted, established brokerage. Fidelity’s combination of learning tools, research quality, and investment options makes it ideal for beginners planning long-term relationships with their platform.

Choose Charles Schwab’s thinkorswim if you’re ready to tackle advanced concepts like technical analysis and options trading with professional-grade tools. The platform’s complexity pays dividends for committed learners willing to invest time mastering sophisticated features.

Choose Webull if you want unlimited paper trading with advanced charting tools in a mobile-first design. Webull’s zero-cost options trading and intuitive interface make it perfect for tech-savvy beginners who primarily trade from smartphones.

Choose SoFi if you want integrated financial services that teach investing within the context of overall financial wellness. The free financial planning consultations provide personalized guidance that pure trading platforms cannot match.

The statistics supporting educational preparation are compelling: 86% of students already use AI in their studies, and 75% of retail trades globally are executed via smartphone apps. The tools available today comprehensive educational platforms, risk-free paper trading, AI-powered insights, and commission-free execution provide unprecedented opportunities for beginners to develop investing skills that previous generations couldn’t access without substantial capital or industry connections.

However, success requires patience and discipline. Research unequivocally demonstrates that beginners who extensively practice with paper trading before committing real capital achieve significantly better outcomes than those who immediately trade live accounts. Resist the temptation to shortcut the learning process the months spent in simulation represent invaluable insurance against costly mistakes that many beginners make with real money.

Your immediate action steps:

The journey from beginner to confident investor unfolds trade by trade, lesson by lesson, mistake by mistake in simulation environments where mistakes cost nothing but teach everything. The best apps that teach you how to invest provide the rails for that journey comprehensive education, realistic practice, transparent costs, and intuitive interfaces that make learning engaging rather than overwhelming. Choose wisely, practice diligently, and remember that trading education is measured in years, not weeks. The skills you develop through patient, deliberate practice with the right platform will compound in value throughout your investing lifetime.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.