Artificial intelligence is quickly becoming a competitive edge for advisors who know how to use it – not a robot replacement for human judgment. Firms that deploy AI for Financial Advisors often report that they can deliver more personalized planning, respond faster to clients, and run leaner operations – while still keeping compliance and control at the center.

This article explains how AI financial planning tools work in real advisory workflows, from client discovery and portfolio construction to compliance reviews and marketing. You’ll see what’s realistic today, what’s coming next, and how RIAs, broker-dealers, and hybrid advisors can adopt AI safely and profitably – while keeping the advisor-client relationship at the center.

Artificial intelligence (AI) in wealth management refers to software systems that learn from data to perform tasks that normally require human judgment – such as interpreting language, spotting patterns in portfolios, or anticipating client needs. Machine learning (ML) is a subset of AI that uses algorithms trained on historical data to improve performance over time.

Sentiment in the industry has shifted from curiosity to urgency. For example, Advisor360°’s 2025 Connected Wealth Report (surveying 300 U.S.-based financial advisors at enterprise wealth management firms) found 85% of advisors call Gen AI a “help” to their practice, and 9% said they don’t use Gen AI tools at all.

For RIAs, the key question has become: How can AI financial planning be used responsibly to enhance advice, rather than automate away the advisor’s unique value? The rest of this article answers that by breaking down technologies, real use cases, and implementation guardrails.

AI comes to life in wealth management through a few core technologies. Understanding them helps demystify what “AI financial advisor” tools are doing behind the scenes.

Natural Language Processing (NLP) enables computers to understand, summarize, and generate human language. In advisory firms, NLP is increasingly embedded in CRM systems, note-taking tools, and compliance reviews.

Common uses of NLP in AI for Financial Advisors include:

For example, an RIA might use NLP-based financial planning AI tools to auto-tag notes with topics like “retirement income,” “concentrated stock risk,” or “estate planning,” feeding structured data into their planning software.

Machine learning algorithms learn from historical data to make predictions or classifications. In AI financial planning, ML often focuses on suggesting strategies, monitoring behaviors, and supporting portfolio decisions.

ML-driven functions often include:

For a mid-sized hybrid RIA, ML might flag clients with high cash balances and low risk usage strong candidates for proactive outreach about more suitable allocations.

Predictive analytics combine statistics, ML, and domain logic to forecast future outcomes. While ML is often the engine, predictive analytics is the application layer that answers, “What’s likely to happen next?”

Typical wealth-management use cases:

In practice, predictive analytics can allow an AI finance advisor system to surface a weekly list of potentially “at-risk” clients, so human advisors can intervene early with calls or review meetings.

AI is most valuable when it’s embedded in everyday workflows. These seven applications show where AI financial planning is delivering tangible results for modern firms.

AI for Financial Advisors enables deeper personalization beyond simple age-and-risk-score models. By analyzing client behavior such as site logins, content consumed, or questions asked- AI systems can infer interests and concerns.

An AI financial advisor solution might:

For RIAs, AI financial planning can make the planning process more dynamic. Instead of relying solely on static annual reviews, the system can prompt advisors when a client’s spending drifts from plan assumptions or when new tax strategies may be relevant.

Regulation is one of the biggest friction points in advisory businesses. AI can help reduce the burden while supporting oversight.

Practical uses include:

Instead of manually sampling emails, compliance officers can use AI financial planning software with built-in NLP models to scan communications at scale, surfacing higher-risk items for human review.

Advisors often spend significant time typing notes, filing documents, and re-keying data. AI-based automation is changing that.

Examples:

These capabilities let an AI financial planner solution handle administrative work in the background so advisors can spend more time with clients and less time on manual tasks.

AI can be especially useful in complex, data-heavy tasks like portfolio analysis. Rather than manually running scenarios in spreadsheets, advisors can use AI to evaluate many combinations efficiently.

Common capabilities:

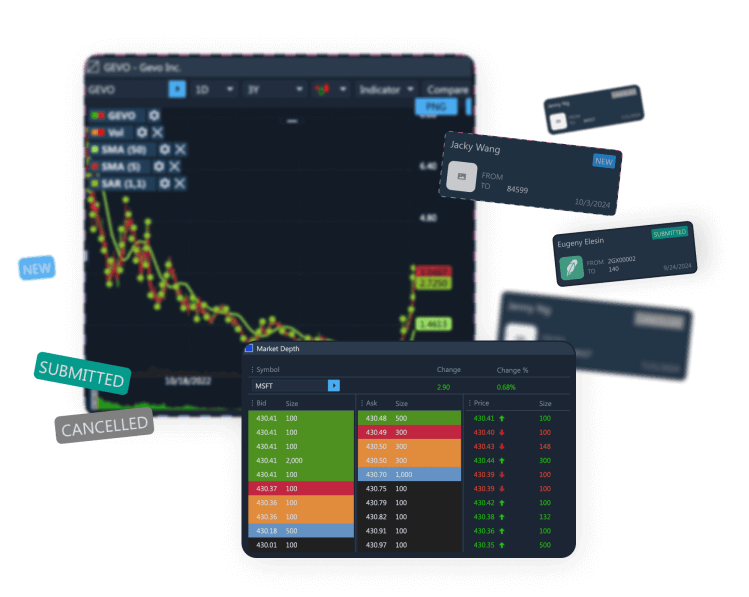

Here, advanced trading infrastructure can be an important consideration. For example, ETNA provides a broker-dealer trading software platform with OMS/EMS capabilities (including order routing, allocation, approvals, and risk across multiple asset classes). ETNA also offers ETNA Trader, which is positioned as an options trading front-end with real-time options analytics (e.g., streaming option quotes and Greeks).

In a typical workflow, AI financial planning software proposes tax-aware rebalancing trades; the advisor reviews them, then routes orders through the firm’s OMS/EMS (which may be provided by a vendor platform), where risk checks, routing, and execution occur within defined controls and are captured for back-office processes.

Traditional risk tolerance questionnaires are static snapshots. AI enables more dynamic, continuous risk assessment.

Practical examples:

For a fee-based RIA, an AI financial planning system might generate a weekly “risk exceptions” report, highlighting clients whose portfolios fall outside policy ranges after recent market moves.

Marketing is where many firms are first experimenting with AI for Financial Advisors because results are often measurable.

AI-driven capabilities include:

Using these tools, a small RIA can run more structured campaigns without requiring a large marketing team, and can explore what some refer to as the “best ai for financial planning” in a broader sense not only investment support, but also business development workflows.

Ultimately, AI’s biggest business impact is often on capacity and margins. By automating routine tasks and enabling semi-automated service models, firms may be able to serve more households without diluting quality.

Examples:

This is where AI financial planning intersects with strategy: firms can reevaluate which clients they can serve profitably and how to allocate human time to the highest-value interactions.

| Application | AI Function | Primary Advisor Benefit |

|---|---|---|

| 1. Client engagement & personalized advice | NLP, behavior analysis | More relevant advice, higher client satisfaction |

| 2. Compliance & reporting | NLP, classification, anomaly detection | Lower compliance risk, faster reviews |

| 3. Back-office automation (docs & notes) | Speech-to-text, document AI | Time savings, fewer manual errors |

| 4. Portfolio insights & optimization | ML, optimization, predictive analytics | Better risk-adjusted portfolios, faster decisions |

| 5. Proactive risk assessment | Continuous monitoring, risk analytics | Early detection of mismatches and risk drift |

| 6. Marketing segmentation & lead nurturing | Predictive scoring, segmentation models | More efficient client acquisition |

| 7. Cost reduction & scalable service models | Workflow automation, chatbots, templates | Higher capacity per advisor, improved margins |

Adopting AI financial planning tools isn’t just a software purchase; it’s also an operational and ethical project. Ignoring this side can increase regulatory and reputational risk.

AI systems are only as safe as the data pipelines feeding them. Advisors frequently work with sensitive personal and financial information, making security non-negotiable.

Key practices:

For RIAs, it’s important to verify that AI vendors do not use client data to train broad, cross-client models without explicit consent and contractual safeguards.

Regulators are increasingly focused on governance, supervision, and conflicts of interest in firms’ use of AI and related analytics. For example, the SEC proposed a rule in July 2023 to address conflicts tied to “predictive data analytics” used in investor interactions, and later withdrew that proposal in June 2025. Separately, FINRA’s Regulatory Notice 24-09 (June 27, 2024) reminds member firms that existing regulatory obligations still apply when using Gen AI and LLMs.

Consider:

Many compliance teams review AI-enabled tools similarly to other material technology changes through due diligence questionnaires, testing, and periodic audits.

AI should augment, not replace, the relationship between advisor and client. The most successful implementations treat AI like a capable assistant, not an autonomous decision-maker.

Practical guidelines:

Client comfort with AI varies. A 2023 CNBC Your Money Survey found 37% of U.S. adults were interested in using AI tools (such as ChatGPT) to help manage their money. Many firms position AI as support for monitoring, documentation, and scenario analysis – while reserving the most personal trade-offs and accountability for human-led conversations.

As AI becomes embedded in major software platforms, the role of the advisor is likely to shift away from spreadsheet-building and rote analysis toward behavioral coaching, strategy, and technology orchestration.

Advisors who thrive will likely:

In this environment, an effective AI financial advisor experience is less about a standalone robot and more about a carefully curated stack of financial planning AI tools integrated into a coherent workflow.

In summary, AI financial planning is transforming how advisors engage clients, build portfolios, run operations, and grow their businesses – especially in RIA and hybrid models that treat technology as a strategic asset. As firms layer AI into planning, trading, and back-office systems, success depends on strong governance, clear supervision, and infrastructure that makes AI-supported strategies operational at scale.

No, AI is more likely to replace specific tasks than entire advisor roles. Data entry, basic portfolio rebalancing, and simple reporting will increasingly be automated. Advisors who focus on client relationships, complex planning, and interpreting AI insights will remain essential. AI for Financial Advisors is a force multiplier, not a substitute for human trust.

AI can improve portfolio precision by analyzing more scenarios and constraints than are practical to handle manually. ML models can help detect correlations, estimate risk more granularly, and simulate many market paths. When integrated with execution platforms and rebalancing tools, AI financial planning can help keep portfolios closer to target risk and tax profiles over time, subject to market conditions and firm oversight.

Costs vary widely. Some entry-level AI financial planner or AI financial advisor tools are bundled into existing CRMs or planning suites with little incremental cost. Standalone AI modules might run a few hundred dollars per user per month, while fully custom solutions can reach enterprise pricing. Many firms start with low-cost or free trials before committing. There are even free AI financial advisor chatbots for basic client education, though they should be supervised carefully.

Advisors don’t need to become data scientists, but they should develop data literacy and critical thinking. That includes understanding model limitations, asking why a recommendation was made, and explaining outputs in plain language. Comfort with digital workflows, basic statistics, and risk concepts helps. The most valuable skill is the ability to combine AI-generated insights with human judgment and client context.

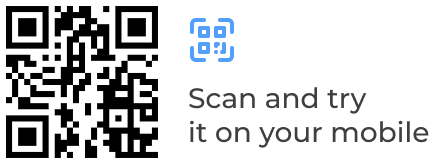

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

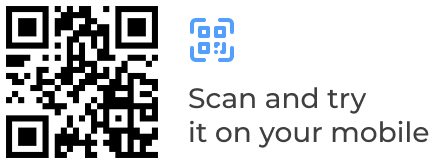

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.