The RIA industry is scaling up fast. SEC‑registered advisers now manage roughly $144.6 trillion for 68.4 million clients, with the number of firms and clients both growing mid‑single digits annually. At the same time, RIA industry consolidation has accelerated to record levels, fueled by private equity, aging founders, and the rising cost of staying competitive.

For principals and COOs, the strategic question is no longer whether consolidation is reshaping the landscape, but whether your firm’s technology and operating model are built to thrive in a market dominated by larger, tech-forward competitors.

This article outlines three pillars of staying future‑proof:

RIA M&A is now structurally embedded in the industry. Depending on methodology, analysts counted roughly 270–360 RIA transactions in 2024, both record levels, with 2025 on pace to exceed 300–380 deals. Private‑equity‑backed consolidators and “platform RIAs” are increasingly setting the pace, while strategic RIA buyers and custodial platforms compete for scale and capability.

| Acquirer Type | Primary Motivation | Typical Target Size (AUM) | Key Challenge |

| PE‑Backed Aggregators / “Meta‑RIAs” | Build enterprise‑scale platforms, roll up revenue and EBITDA, and arbitrage valuation multiples. | $500M–$5B+, increasingly mid‑market $500M–$1B. | Integration at scale: culture, investment philosophy, and fragmented tech stacks. |

| Strategic Acquirers / Large RIAs | Add capabilities, geographies, or niches; accelerate inorganic growth; deepen talent bench. | $100M–$2B (often regionally strong, founder‑led). | Balancing integration with local autonomy; keeping high‑touch service while standardizing ops. |

| Custodial / Platform Providers | Lock in assets, capture trading/clearing economics, deepen share of advisor wallet. | Wide range; RIAs and teams that can scale on their platform. | Avoiding channel conflict, delivering a differentiated advisor experience vs. other platforms. |

The result is a barbell market: a small cohort of large firms captures a growing share of assets one analysis suggests roughly 70% of assets are now managed by about 7% of firms, with half of assets at just 2% of firms. Smaller RIAs must either professionalize rapidly or explore partnerships, affiliations, or transactions to remain competitive.

Several structural forces continue to push RIA industry consolidation higher:

Despite record volume, not all consolidation creates value. Integration risk is mounting:

The common thread: technology and data architecture are increasingly central to whether consolidation outcomes are accretive. RIAs need tech stacks and partners that can absorb growth, support complex trading, and keep data normalized across multiple custodians and legacy systems.

If consolidation is the structural trend, technology is the critical lever for staying independent, joining a platform on your terms, or scaling as an acquirer. Surveys show:

Below is a non‑exhaustive snapshot of leading RIA platform solutions frequently cited by advisors, along with a trading‑focused layer tailored for active RIAs.

| Platform / Tool | Best For | Key Feature Highlight |

| Orion | Firms seeking a full, integrated wealth platform | Deep integration of PMS, planning, billing, and client experience; strong workflows. |

| Black Diamond Wealth Platform | HNW / UHNW and multi‑custodial RIAs | Powerful reporting and data aggregation across complex balance sheets. |

| RightCapital | Planning‑heavy and tax‑aware firms | User‑friendly cash‑flow and tax planning; strong client portal adoption. |

| Advyzon | Growth‑oriented small and midsize RIAs | All‑in‑one PMS + CRM + reporting with simpler implementation and pricing. |

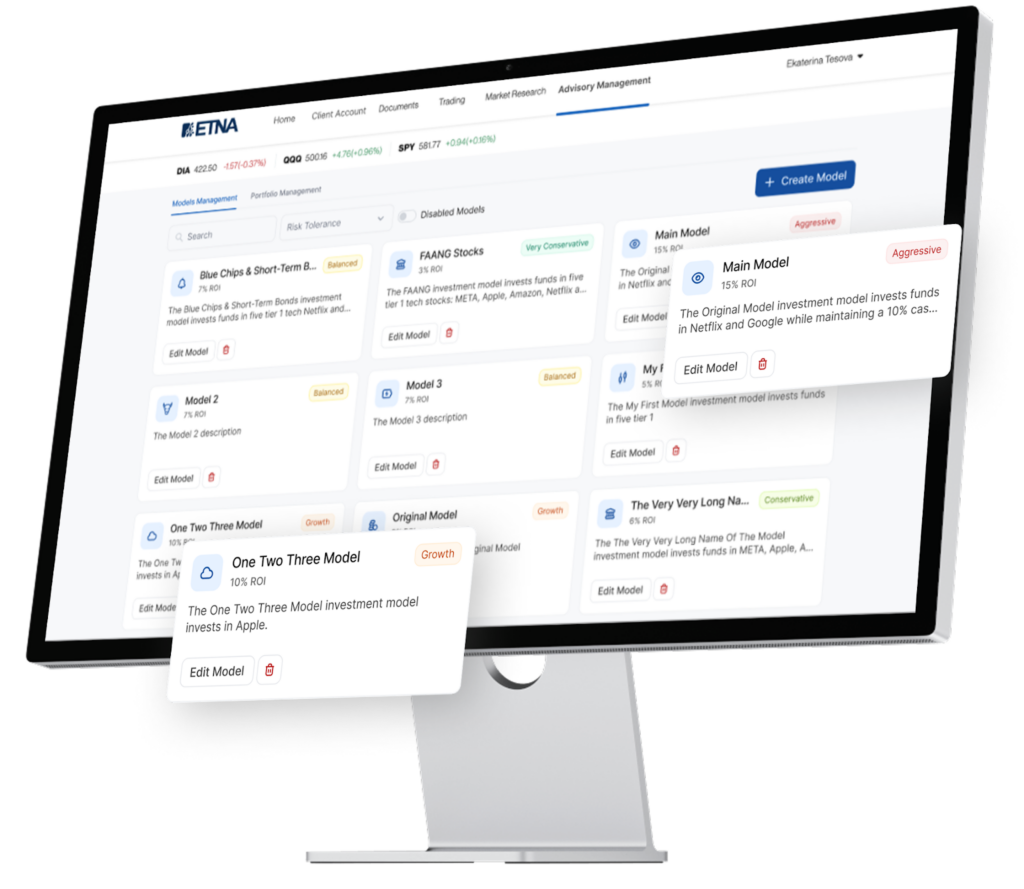

| ETNA white‑label RIA trading platform | Active, trading‑intensive, or multi‑asset RIAs | Advanced order management, multi‑asset trading, robust APIs for custom workflows. |

Trading is often the weakest and most fragmented layer in traditional advisor tech stacks. For RIAs serving active investors, options users, or offering model‑driven strategies, a dedicated, white‑labeled, tightly integrated trading platform is a competitive weapon.

The ETNA white‑label RIA trading platform is designed to sit alongside your PMS and CRM as the execution and trading intelligence layer of a modern RIA stack. In practice, that means:

In an environment where many custodians and TAMPs are racing to offer “good enough” trading capabilities, owning a flexible, API‑driven trading layer lets RIAs experiment with AI‑powered strategies while keeping the advisor firmly “in the loop.”

When evaluating RIA platform solutions, decision makers should use a future‑back lens rather than simply solving for current pain points. A practical checklist:

Younger and more digitally native investors are accelerating the shift toward always‑on, personalized, and transparent experiences. They compare their advisor’s portal to consumer apps not to legacy broker workstations.

“Gen X and Millennial clients now expect their RIA to feel like a modern fintech app with a human fiduciary behind it: intuitive digital self‑service, real‑time visibility into their portfolios and goals, and proactive insights powered by data and AI. Firms that cannot deliver this integrated experience will increasingly lose next‑generation wealth to more tech‑forward competitors.”

Surveys show that 89% of RIAs agree that delivering a high‑quality digital experience is a major competitive advantage, and 71% plan moderate or aggressive investment in onboarding and account data management technologies over the next two years. That spending is increasingly directed toward integrated RIA platform solutions that unify planning, reporting, messaging, and critically trading.

AI has shifted from hype to utility in wealth management:

Today’s practical use cases include:

On the investment side, AI‑driven and algorithmic trading tools once limited to hedge funds are now widely accessible. Platforms and tools provide:

For RIAs, the key isn’t to “out‑bot” retail day traders. It is to selectively embed AI into the trading and monitoring layer to:

Platforms like the ETNA white‑label RIA trading platform, with their API‑first design, multi‑asset support, and integration into existing stacks, are well‑positioned to serve as the execution backbone for advisor‑supervised AI and quant workflows.

Fee compression continues, particularly for basic asset management. At the same time, clients increasingly expect holistic wealth services tax, estate, business succession, and even cash‑flow and benefits optimization within a single relationship.

Winning RIAs respond not by racing to the lowest basis point fee, but by:

Regulators are paying close attention to how RIAs use technology especially AI and digital engagement. Beyond ongoing focus areas such as Reg BI (for dually registered advisors), cybersecurity, and off‑channel communications, one particularly important prospective change is the SEC’s proposed rule on conflicts of interest arising from the use of predictive data analytics and similar technologies.

Predictive Data Analytics & AI Conflicts Rule (Proposed)

The SEC has proposed rules that would require broker‑dealers and RIAs to identify and eliminate or neutralize conflicts of interest that arise from their use of predictive data analytics, machine learning, and other optimization technologies in investor interactions. In practice, if finalized, RIAs using AI‑driven tools to recommend or trade securities may need to:

For RIA leaders, this reinforces the need for:

RIA industry consolidation will not reverse. Record M&A volume, rising private equity participation, and increasing asset concentration at large firms all point toward a more institutionalized marketplace. Yet the same forces creating “mega‑RIAs” also create opportunities for agile firms that can leverage technology and niche specialization.

The strategic imperatives are clear:

A practical next step is to perform a joint M&A and tech‑stack strategy review:

Firms that move now modernizing their tech stack, experimenting with AI under strong governance, and clarifying their role in the consolidation wave will be the RIAs that not only survive the next five years, but set the standard for what a “future‑proof” advisory business looks like.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.