The financial services landscape is experiencing a technological revolution that is fundamentally reshaping how investment advice and portfolio management are delivered. Robo-advisors, once viewed as disruptive competitors to traditional wealth management, have evolved into sophisticated platforms managing over $1.2 trillion in global assets as of 2024. For broker-dealers, registered investment advisors (RIAs), and wealth management firms, understanding the strategic implications of robo-advisor technology is no longer optional it’s essential for survival and growth in an increasingly digital marketplace.

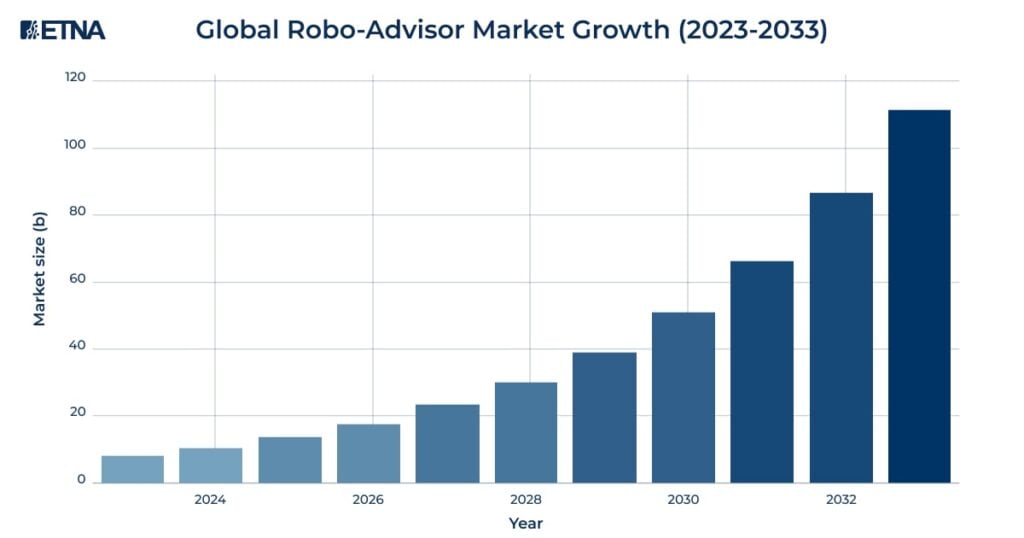

The global robo-advisory market is experiencing unprecedented expansion, with projections indicating growth from $8.4 billion in 2023 to $116.4 billion by 2033 representing a compound annual growth rate (CAGR) of 30.3%. This explosive growth reflects not just consumer demand, but a fundamental shift in how financial services are conceptualized, delivered, and scaled.

The global robo-advisor market is experiencing explosive growth, projected to increase from $8.4 billion in 2023 to $116.4 billion by 2033

The robo-advisory sector has transcended its initial positioning as a millennial-focused investment tool to become a cornerstone of modern wealth management infrastructure. North America dominates the global market with 43.74% market share, while the sector is expected to reach 34.13 million users by 2028.

Hybrid robo-advisors represent the fastest-growing segment, capturing 60.7% of 2024 revenue as firms recognize the value of combining algorithmic efficiency with human oversight. This trend reflects the evolution toward Robo-Advisor 4.0, characterized by AI-powered personalization, comprehensive financial planning, and seamless integration with traditional advisory services.

The adoption patterns reveal significant insights about the future of wealth management. Millennial and Gen Z investors, who represent 70% of mobile app users for investment management, are driving demand for digital-first solutions. However, the demographic is expanding beyond young investors high-net-worth individuals contributed 55.3% of 2024 volume, indicating broad-based acceptance across wealth segments.

The regulatory landscape is evolving to accommodate robo-advisory growth while ensuring investor protection. Enhanced best execution requirements and increased focus on algorithmic transparency are driving firms toward more sophisticated compliance frameworks. This regulatory maturation is reducing barriers to adoption while establishing standards that benefit both providers and consumers.

Robo-advisors offer significant cost and accessibility advantages, but struggle with personalization and complex financial planning needs

Dramatic cost reduction represents the most compelling advantage of robo-advisory platforms. Traditional financial advisors typically charge 1-2% of assets under management (AUM), while robo-advisors operate at 0.25-0.50% annually. This cost differential isn’t merely about pricing it reflects a fundamentally different operational model that leverages automation to achieve scale economies.

For broker-dealers and RIAs, this cost structure enables profitable service delivery to previously uneconomical client segments. Mass affluent investors with $25,000-$250,000 in investable assets, traditionally underserved due to cost constraints, become viable through robo-advisory platforms.

Robo-advisors have democratized access to sophisticated portfolio management strategies previously reserved for high-net-worth clients. No minimum investment requirements or minimums as low as $500 enable firms to capture assets from emerging investors and serve as a gateway to more comprehensive services.

This accessibility extends beyond capital requirements to include 24/7 availability, multilingual interfaces, and simplified onboarding processes that reduce friction in the client acquisition funnel.

Modern robo-advisors leverage Nobel Prize-winning Modern Portfolio Theory (MPT) and sophisticated algorithms to deliver institutional-quality portfolio management. Key capabilities include:

For wealth management firms, robo-advisors provide significant operational leverage. Automated workflows handle client onboarding, risk profiling, portfolio construction, rebalancing, and reporting with minimal human intervention. This automation allows human advisors to focus on high-value activities such as financial planning, relationship management, and complex problem-solving.

Advanced robo-advisors utilize big data analytics and machine learning to deliver increasingly personalized investment experiences. Predictive analytics enable proactive portfolio adjustments based on market conditions, while behavioral analytics help optimize client engagement and retention.

Despite algorithmic sophistication, robo-advisors fundamentally operate with “one-size-fits-most” approaches that may not address complex financial situations. Estate planning, tax strategy optimization, business succession planning, and multi-generational wealth management require human expertise and nuanced understanding that algorithms cannot replicate.

Financial decision-making is inherently emotional, particularly during market volatility. Robo-advisors cannot provide the reassurance, behavioral coaching, and emotional support that human advisors offer during challenging market conditions. This limitation becomes particularly problematic during crisis periods when clients most need guidance and perspective.

The “black box” nature of algorithmic decision-making creates transparency challenges. Clients may not understand the rationale behind investment decisions, and advisors may struggle to explain automated portfolio adjustments. Additionally, algorithmic biases and model limitations can lead to suboptimal outcomes during unprecedented market conditions.

Robo-advisors are susceptible to technical glitches, cybersecurity threats, and system outages that can disrupt client service. The reliance on technology infrastructure creates operational risks that traditional advisory models don’t face, potentially impacting client confidence and regulatory compliance.

Most robo-advisors restrict investments to predetermined ETF portfolios, limiting clients’ ability to access individual stocks, alternative investments, or specialized strategies. This constraint may frustrate sophisticated investors seeking broader investment opportunities or unique portfolio customization.

Robo-advisors face higher client churn rates compared to traditional advisory relationships, particularly during unfavorable market conditions. The lack of personal relationships and the transactional nature of digital interactions make it easier for clients to switch providers or abandon investment strategies during challenging periods.

Betterment and Wealthfront, the industry pioneers launched in 2008, continue to lead the pure-play segment. Betterment focuses on goal-based investing with optional human advisor access through its Premium tier (0.65% fee), while Wealthfront emphasizes tax optimization and automated financial planning tools at a flat 0.25% fee.

Key differentiators include:

Vanguard Digital Advisor leads the hybrid category, combining low-cost index fund expertise with human advisor access for accounts over $50,000. The platform charges 0.20-0.30% annually and leverages Vanguard’s Life-Cycle Investing Model for age-appropriate portfolio construction.

Charles Schwab Intelligent Portfolios offers commission-free robo-advisory with no management fees, generating revenue through cash allocation strategies and underlying fund expenses.

Fidelity Go provides free management for accounts under $25,000 and 0.35% fees thereafter, featuring zero-expense-ratio Fidelity Flex funds and integrated advisor access.

LSEG (formerly Refinitiv) offers enterprise-grade robo-advisory solutions for financial institutions seeking white-label capabilities. These B2B2C platforms enable banks and broker-dealers to launch branded robo-advisory services without internal development costs.

SS&C Eze and Charles River provide institutional-quality order management and portfolio management systems that support robo-advisory functionality for larger wealth management firms.

Current industry data reveals significant adoption momentum across multiple metrics:

Performance analysis indicates robo-advisors generally deliver market-matching returns after fees, with tax-loss harvesting providing additional alpha for taxable accounts. Cost advantages remain substantial, with average expense ratios of 0.04-0.11% for underlying funds plus 0.25-0.50% management fees.

ETNA Software stands at the forefront of robo-advisory infrastructure, providing white-label solutions that enable broker-dealers and RIAs to deploy sophisticated digital advisory platforms under their own brands. The ETNA Robo-Advisor API offers a comprehensive Platform-as-a-Service (PaaS) model that includes all essential functionality without requiring internal development resources.

Core platform capabilities include:

ETNA’s robo-advisory solution provides institutional-grade order management through integrated OMS/EMS capabilities that automate execution, pre- and post-trade risk management, margin monitoring, and compliance reporting. The platform supports both individual account management and master account models with sophisticated trade allocation functionality.

Risk management features include:

The ETNA platform offers unprecedented customization capabilities, enabling firms to configure investment models, adjust risk parameters, and modify portfolio allocations through an intuitive back-office interface. Firms can create unlimited investment strategies ranging from conservative to aggressive, with sector-specific themes such as technology, healthcare, or ESG-focused portfolios.

Scalability benefits include:

ETNA’s unique advantage lies in its seamless integration between robo-advisory and professional trading platforms. Clients can transition between automated and discretionary management within the same account infrastructure, enabling firms to serve diverse client needs and facilitate natural progression as investors become more sophisticated.

For broker-dealers and RIAs, ETNA’s robo-advisory solution addresses critical market needs:

For broker-dealers and RIAs evaluating robo-advisory strategies, the evidence indicates that digital automation is not optional but essential for long-term competitiveness. However, success requires thoughtful implementation that leverages technology strengths while preserving human value where it matters most.

Key strategic imperatives include:

ETNA Software represents an optimal solution for firms seeking to implement sophisticated robo-advisory capabilities without the complexity and cost of internal development. The platform’s comprehensive feature set, white-label flexibility, and proven scalability enable firms to compete effectively in the evolving digital wealth management landscape.

The robo-advisory revolution is not about replacing human advisors it’s about amplifying human capabilities through intelligent automation. Firms that successfully integrate these technologies while preserving the essential human elements of financial advice will capture the greatest opportunities in the decade ahead.

The future belongs to wealth management firms that can deliver the efficiency of algorithms with the wisdom of human experience. In this context, robo-advisors are not competitive threats but powerful tools for delivering superior client outcomes at scale.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.