Who is a broker-dealer?

Most of people who use “broker-dealer” term have little understanding what does it mean and what is involved to become a broker-dealer.

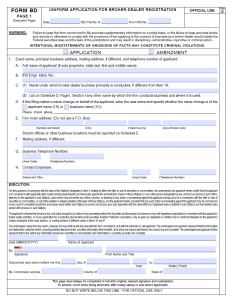

Broker-dealer must hold a license and to do that he must complete 28-pages uniform application for broker-dealer registration. This application asks certain questions like:

- Who are principals?

- Who will be CEO and CFO?

- Will the broker-dealer be a market maker?

- What is the tax ID number?

- Where the main office will be located?

- Who will be self-regulatory organization?

- Will broker-dealer accept checks from client?

- What security types broker-dealer will deal with?

The completed application is sent to the Security Exchange Commission (SEC), where it is reviewed and if everything is ok, the license will be issued.

Individuals who trade for their own accounts on the trading floor and the largest investments banks – all are considered to be broker-dealers. It’s very wide term, there are a lot of different types of broker-dealers:

- Clearing broker-dealer – member of clearing corporation, such as National Securities Clearing Corporation (NSCC) that compares and settles trades against other broker-dealers

- Discount broker – offers low commission because does not provide full suite of services

- Futures trading firm – trade on the floor of futures exchange

- Institutional broker-dealer – offers services to institutions such as hedge funds, mutual funds or trust companies

- Introducing broker – uses the services of another firm to clear and settle trades

- Online broker-dealer – their clients enter orders via Web. Everything is done electronically.

- Market maker – trades certain securities against their clients

- Specialist – member of an exchange

And one more thing to be clarified – even the term “broker-dealers” refers to the license (“Form BD”), there is a difference between the “broker” and the “dealer”:

- Broker purchases and sells securities on behalf of their client, but never trades against the client order.

- Dealer holds the position and trades against the public.

- Broker-dealer participates in both activities – trade securities for clients and trade securities against the client.

Further details: how is broker-dealer software environment designed, an overview of brokerage regulations in the US.

Nice blog! Great reading this.

FinancialAdvisorPlacementServices.com

The Forex is real, however there are two forms of Forex Trading . On Exchange and Off Exchange This is a fact that few pepole know about.On Exchange currency trading is only offered by two companies at the time I was doing my research. Ducas Copy and FXCM. Only one is American: FXCM. and they only trade On Exchange if you have an account with 25k or more in it. And with them you want to ask for an off shore trade account- so you wont be limited in leverage and your allowed to hedge. All yes- I mean ALL the other brokerages trade OFF EXCHANGE Gain Capital , ACM, CMS, MB,PFG,easy forex, jforex, to name a few. OFF EXCHANGE means just that- its not traded on the real exchange. What it is traded on is an online game that each company creates themselves. Creates, controls, and alters at will. No different than playing online poker. Your playing against the house and the table is controlled by them. Since they always take the position of the opposing party- its in their best interest that you loose. Example of how they make you loose: (exerpt from Gain Capital’s account contract section 4.2:____________________________________________________________________.In cases where the prevailing market represents prices different from the prices GAIN Capital has posted on our screen, GAIN Capital will attempt, on a best efforts basis, to execute trades on or close to the prevailing market prices.These prevailing market prices will be the prices, which are ultimately reflected on the Customer Statements.This may or may not adversely affect customer realized and unrealized gains and losses._____________________________________________________________________This means they are trading your account not using the numbers you are being shown on the screen- but by the real market prices.On the game version you can see- the shoots up so you hit the buy tab- in reality the price dropped- in the game you think you made money- then your statement shows up- showing you lost money that day- there’s nothing you can do about it either because you signed the contract that says they are allowed to do all sorts of things to make you loose.As for the university- save your money! go to FXCM’s website- open a practice account- you will have access to all their tutorials- however- all you need to know is to buy when the price drops- then sell when it peaks in the other direction- about 2-7 minutes later. Don’t trade on Fridays or when they are making financial announcements on the news. Open an account with at least 25k or you will be trading off exchange Plus- opening an account with anything less wont get you anywhere fast. With 25k you can make 15k a day. I can- so you can too. Never use more than 1/3 of your margin.Don’t ever use stops Always sit and watch the chart anytime your holding a contract.good luck!