Broker-Dealers

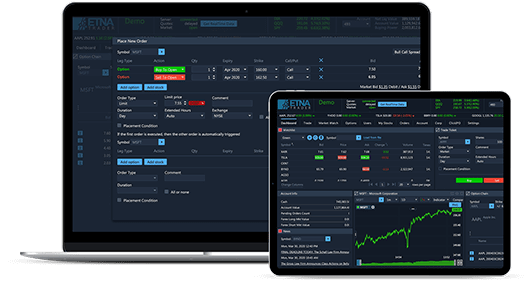

Grow business by offering traders innovative software and reducing operating costs at the same time. Deliver convenient trading experience and increase trading volumes. Pay-per-use white label trading platform.

Digital Advisors

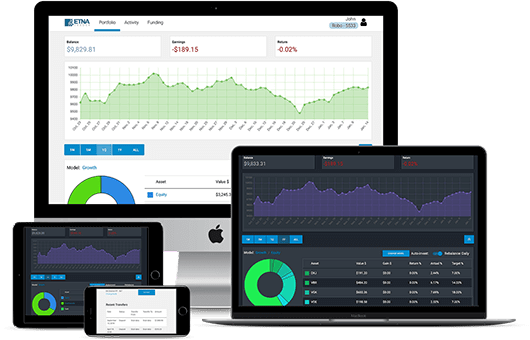

Launch a digital advisor within days and focus on your unique value proposition while we take care of all the technology needs of a modern robo-advisor. Client Dashboards, Portfolio Rebalancing, OMS and Back Office.

Trading Educators

White Label online trading simulator is a perfect educational tool to educate the next generation of online investors. Customize trading rules, control student access and progress with back office portal.

White Label Trading Technology for Online Brokerage, Digital Advisors and FinTech Firms

ETNA provides an all-in-one white label software solution to run an online brokerage or digital wealth management business.

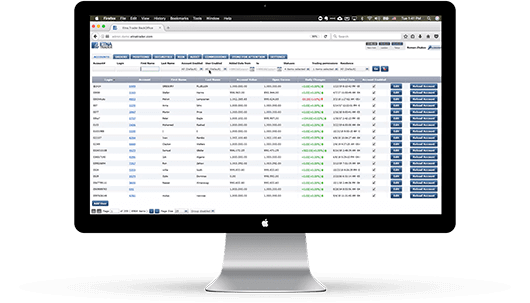

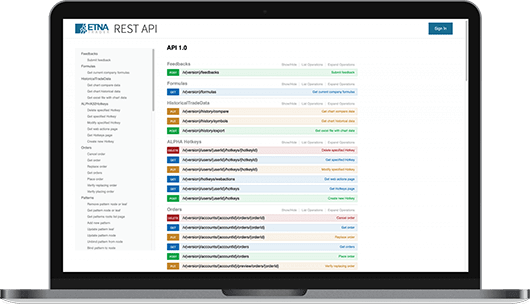

ETNA's white label trading platform features Web Trader and Mobile Trading Applications, Middle and Back Office and Trading APIs. Turn-key stock trading technology is seamlessly integrated via API with execution venues, clearing and market data providers of choice.

ETNA Trader is an all-in-one solution for brokerages focused on self-directed investors and commission-free trading. Conveniently packaged as platform-as-a-service ETNA Trader removes the burden of maintaining costly IT teams and infrastructure.

ETNA Digital Advisor is a white label platform for managing passive investments. Designed for robo-advisors, fund managers and RIAs, ETNA Digital Advisor is a perfect opportunity to expand brokerage offering with advisory services to increase trading volumes and attract new clientele. ETNA facilitates the launch of new wealth management products and services, while WealthTech firms focus on developing unique algorithms and personalized customer experience.

ETNA's trading technology suite takes care of execution, trade lifecycle, pre- and post-trade risk, margin requirements, account balances, trade allocations, compliance and reporting, FIX protocol connectivity, reconciliation of account information with the executing/clearing broker, OATS reporting and many other essential functions of an online brokerage business.